India’s dry fruits market is experiencing rapid growth, driven by rising health awareness, increased disposable incomes, and a preference for convenient, nutritious snacks. Dry fruits market size in India is projected to grow from US$ 9.3 billion in 2024 to US$ 12.7 billion by 2029, at a CAGR of 6.55%. Currently ranked the world’s largest importer, India imported dry fruits worth US$ 2.85 billion in 2023. The market offers significant opportunities, particularly in the cashew segment.

India is an attractive destination for foreign suppliers aiming to capitalize on this demand by offering high-quality products. With the rise of e-commerce, strategic partnerships and growing share of value added products, the industry is set for continued expansion, making it a promising sector for both established and emerging brands.

The global dry fruits market is valued at US$ 66.5 billion in 2023 and is projected to grow at a CAGR of 5.36% to reach US$ 86.3 billion by 2029, according to Statista. On the other hand, the India’s dry fruits market is expected to grow from US$ 9.3 billion in 2024 to US$ 12.7 billion by 2029, with a CAGR of 6.55%. The major drivers of growth in Indian dry fruit market include increasing health awareness, rising disposable incomes, and a shift towards convenient, nutritious snacks. The expansion of e-commerce and innovative packaging solutions have also significantly contributed to market growth. Notably, the consumption of India’s dry fruits increased in 2023 by 25% according to a report.

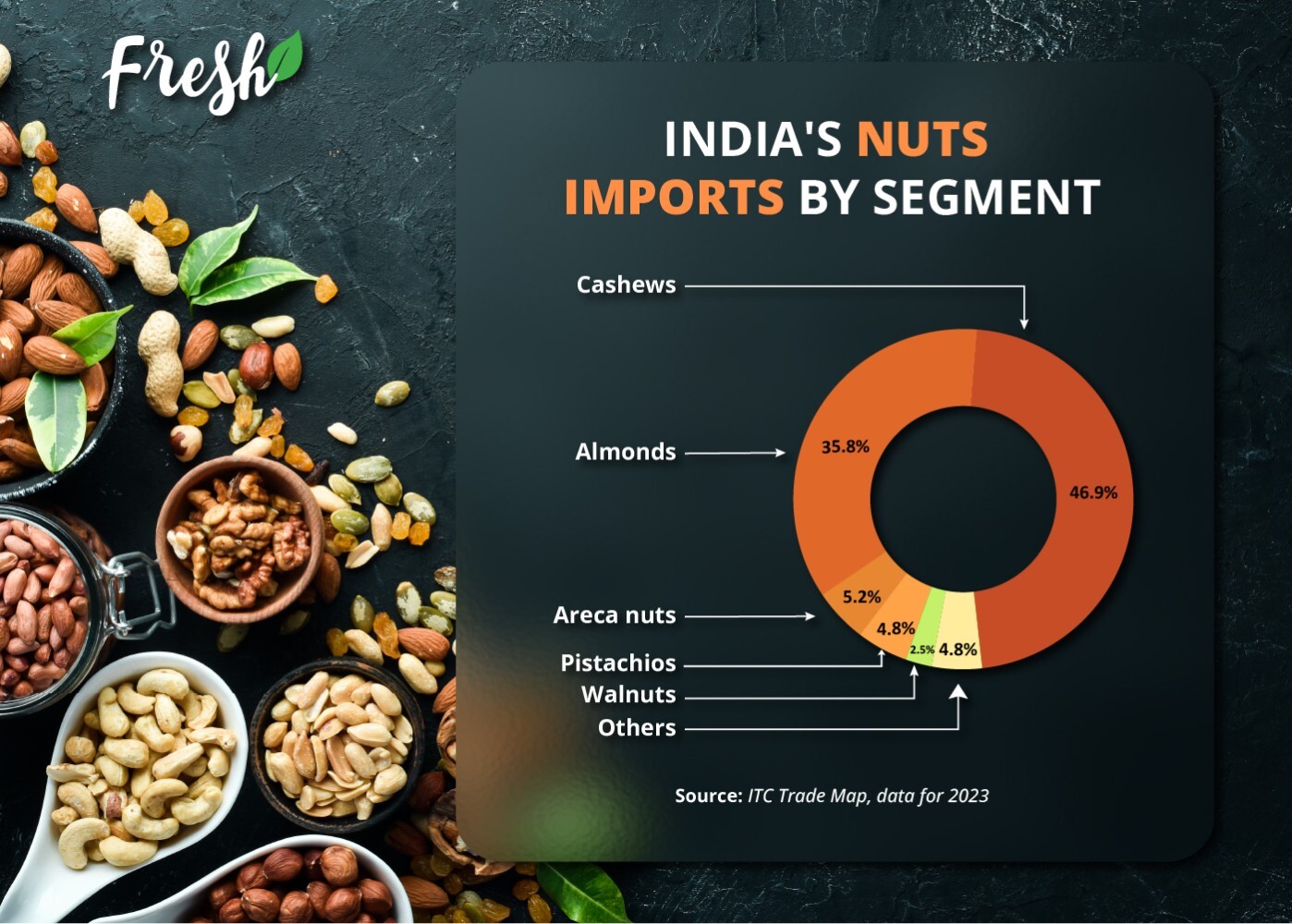

In India, the dominant segment of this market is cashew, which is also the highest imported product. Cashew nuts are available in various forms, including roasted, salted, flavored, and coated with spices or honey. Also, players are coming up with a number of value-added products such as cashew powder, butter, and beverages.

Professor Ranjan Kumar Ghosh of IIM Ahmedabad comments, “The dry fruits and nuts market is booming because of the increasing health awareness of Indian consumers. For instance, urban consumers now prefer nut-mixed cereals more than ever before and have also started substituting for traditional sweets as the best gifting options during major festivals.”

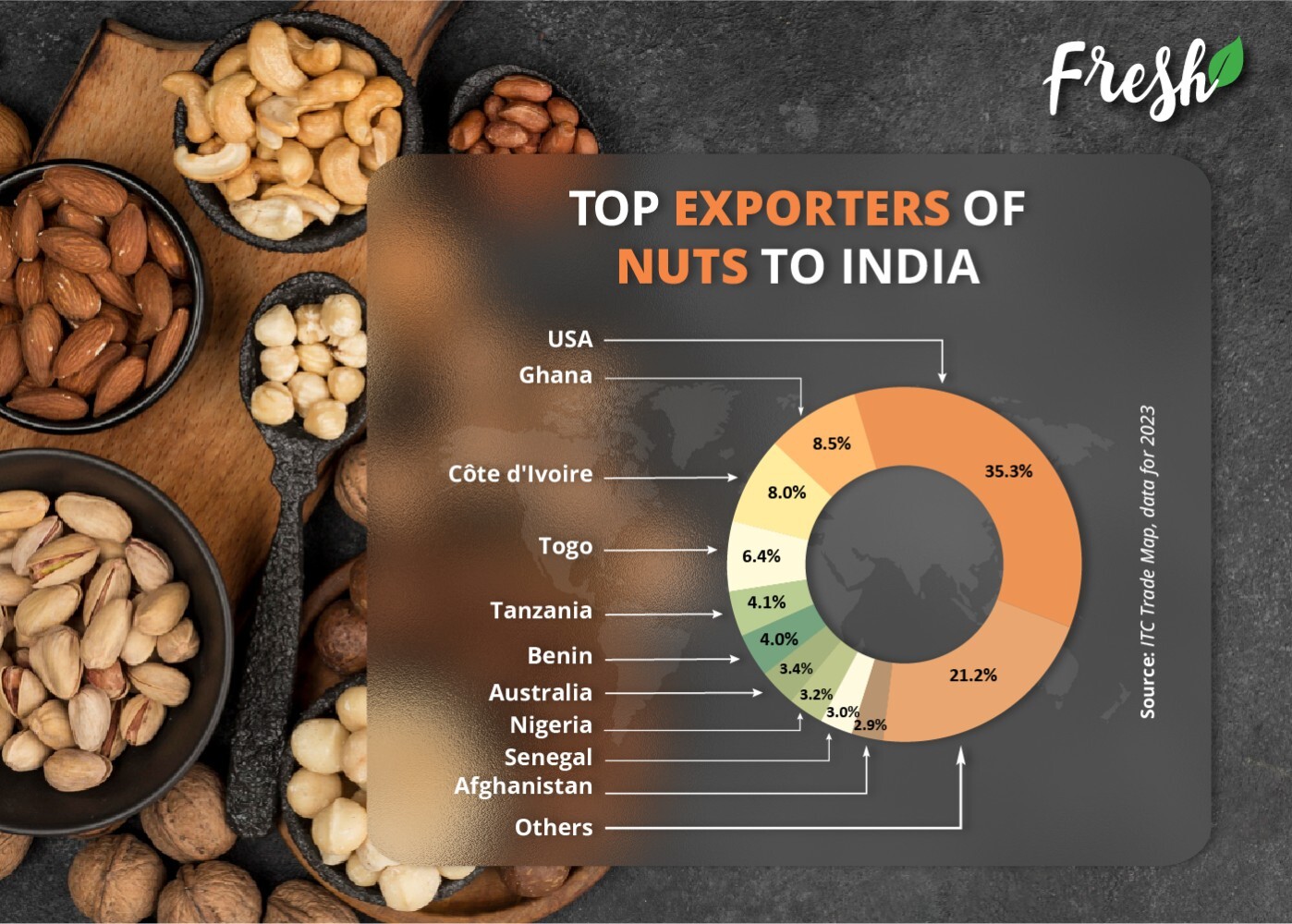

Global imports of nuts reached US$ 25 billion in 2023. India is ranked first in imports of nuts, with a value of US$ 2.85 billion and market share of 11.2%.

The US is the top exporter to India, contributing 35% share. Exports from the US were valued at US$ 1 billion in 2023, with a CAGR of 7% between 2019 and 2023. It was followed by Ghana (US$ 242.4 million, CAGR of 5%), Côte d’Ivoire (US$ 228.5 million, CAGR of -7%), Togo (US$ 182.2 million, CAGR of 30%) and Tanzania (US$ 118.5 million, CAGR of -11%).

Cashews hold a prominent position in India’s dry fruits imports, accounting for nearly 50% of the total share. This highlights a substantial market for cashew exports to India and presents significant opportunities for exporters.

The Indian cashew market is projected to be valued at US$ 2.40 billion in 2024 and is expected to grow to US$ 2.90 billion by 2029, with a CAGR of 3.80% during this period. In India, cashew nuts are available in various forms, including roasted, salted, flavored, and coated with spices or honey. Also, the market features value-added products such as cashew powder, butter, and beverages.

The consumption of dry fruits in India, once concentrated primarily in North Indian states, has now expanded nationwide. More and more people are consuming nuts because they are ready-to-eat, low-processed, nutritious, and convenient snacks. Some of the key growth drivers are as follows:

Health and wellness trends: The rising health consciousness among consumers is significantly driving the demand for nutritious food options, including dried fruits and nuts.

Healthier snacking: Consumer preferences are shifting towards healthier snacking alternatives as people increasingly look for options that fit into their health-focused diets.

Increased disposable incomes: with rising disposable incomes, consumers in India are willing to spend more on premium dried fruit products.

E-commerce growth: The rapid growth of e-commerce platforms has significantly enhanced the accessibility of dried nuts. This allows consumers, especially in rural areas, to purchase these products conveniently, further boosting market growth.

Innovative product offerings: Manufacturers are focussing on introducing innovative products within the dried fruits category, including value-added items like snack bars and breakfast cereals.

Convenience and shelf stability: The long shelf life and convenience of dried nuts make them an attractive option for busy consumers. This factor appeals to those looking for nutritious snacks that require no preparation.

The future of India’s nut market appears promising. India is the second-largest consumer of cashews, peanuts, and almonds, closely followed by raisins, dried figs, walnuts, and dates. The nuts market’s growth is primarily driven by increasing health consciousness, rising demand for convenient snacks, and expanding disposable incomes. As consumers become more aware of the nutritional benefits associated with nuts, their consumption patterns are evolving. This trend is particularly evident among urban demographics, who now prefer healthier alternatives to traditional sweets, further boosting market potential.

This growth presents significant opportunities for both established brands and new market entrants. Existing brands are responding to the increased demand by diversifying their product lines, emphasizing quality, and introducing innovative packaging solutions. With market growth fueled by health-conscious trends, rising income, and convenience, the sector is attracting foreign players, large corporations, and FMCG brands, all looking to penetrate this expanding market.

India, being the top importer of dry fruits, promises many opportunities for foreign players. By aligning their business to positive market trends and consumer preferences, brands can capitalize on the growing demand for premium nuts in India, establishing a strong market presence and expanding their consumer base.

Read more at:

FAQs

-> In 2024, the market was valued at approximately US $9.3 billion, and it is expected to reach US $12.7 billion by 2029, growing at a CAGR of 6.55%.

-> India stands as the world’s largest dry fruit importer, bringing in dry fruits valued at US $2.85 billion in 2023, accounting for around 11.2% of global nut imports . The U.S. is the leading exporter to India (35% share, US $1 billion), followed by Ghana, Côte d’Ivoire, Togo, and Tanzania.

-> Cashews are the top segment—making up nearly 50% of imports. The cashew sector alone is projected to grow from US $2.4 billion in 2024 to US $2.9 billion by 2029 (CAGR 3.8%). Products include roasted, salted, flavored, coated, as well as value-added forms like cashew butter and powder.

-> Rising health awareness and demand for nutritious snacks.

->Increasing disposable incomes enabling purchases of premium dry fruits.

->Rapid e‑commerce expansion, improving accessibility—especially in smaller towns.

->Innovation with value-added products (trail mixes, snack bars, cereals).

->Convenience and longer shelf life, appealing to modern lifestyles

-> The global market was valued at US $66.5 billion in 2023 and is projected to reach US $86.3 billion by 2029 (CAGR 5.36%) .

© Trade Promotion Council of India. All Rights Reserved.