Indian whisky is gaining global recognition, with one-third of the fastest-growing spirits brands worldwide being Indian, and six out of the top ten whisky brands globally originating from India. However, despite its strong international appeal, the export potential of Indian whisky is hindered by various regulatory challenges.

This article delves into these challenges, with a focus on the Australian market, where India has recently signed the Economic Cooperation and Trade Agreement (ECTA). Australia’s two-year maturation requirement for whisky, seen as a non-tariff barrier, limits market access for Indian producers, underscoring the need for regulatory changes to fully realize this opportunity.

India’s alcoholic beverages (alcobev) industry is on a growth trajectory, projected to reach US$ 64 billion by 2027, with a CAGR of 6.54%, according to research by the International Spirits and Wines Association of India (ISWAI). This sector employs 7.9 million people, representing 1.5% of India’s workforce. In the global arena, India is poised to become the fifth-largest market in terms of revenue in the near-to-medium term.

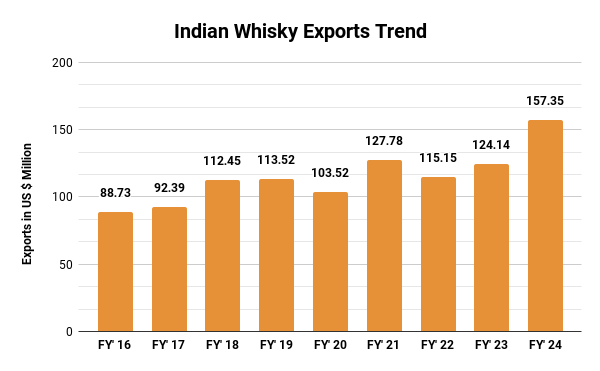

While domestic demand is robust, Indian whisky is also making strides internationally. In 2023, global whisky exports reached over US$ 14.7 billion, with India contributing $145 million, which accounts for nearly 40% of its total alcoholic beverage exports. The UAE leads as the largest importer of Indian whisky, followed by Haiti, Ghana, the Netherlands, and Singapore, together comprising 60% of India’s whisky exports. Despite a 5-year CAGR of 6.7% in exports, the true potential of Indian whisky remains untapped due to limited market diversification.

| Importers | Exported value in 2023 (US$ Mn) |

| United Arab Emirates | 57.3 |

| Haiti | 9.1 |

| Ghana | 7.3 |

| Netherlands | 7.1 |

| Singapore | 6.6 |

Indian spirits, including premium single malt whiskies like Amrut and Rampur, and craft gins such as Jaisalmer and Stranger & Sons, have garnered international acclaim. However, the Confederation of Indian Alcoholic Beverage Companies (CIABC) identifies several export challenges, including stringent foreign regulations and high evaporation rates due to India’s warm climate.

In 2023, Australia imported alcoholic beverages worth $1.5 billion, with whisky being the largest segment, accounting for 21% of the total. The UK dominates this market, exporting whisky worth US$ 164 million to Australia, while India’s whisky exports to Australia were a mere US$ 560,000 in FY 2023-24. The primary obstacle is Australia’s two-year maturation requirement for whisky, which Indian producers argue is unnecessary given the faster maturation process in India’s warmer climate. This rule not only restricts market access but also leads to a 10% loss due to evaporation during the extended maturation period.

Vinod Giri, Director-General of the Brewer’s Association of India, stated, “Australia’s maturation requirements are a significant barrier for Indian liquor products. These regulations are not scientifically justified and overlook the unique maturation process in India’s climate. We are hopeful that future negotiations will lead to the removal of these restrictions.”

The India-Australia interim trade deal under the ECTA granted Australia lower duty access for its high-end wines. India agreed to reduce tariffs on Australian wines over ten years, starting with a reduction from 150% to 100% for wines priced at a minimum of US$5 per bottle. Indian producers now seek similar concessions, specifically the easing of non-tariff barriers like maturation rules.

To address these concerns, a joint working group between India and Australia was established to explore a Mutual Recognition Agreement (MRA). This agreement, initiated seven months after Australia secured concessional duty access for its wines under the ECTA, aims to facilitate Indian whisky’s entry into the Australian market. The working group, as outlined in a side letter of the ECTA, is tasked with reviewing market access issues for Indian spirits, with regular progress checks by the subcommittee on trade in goods.

Sanjeev Banga, President of International Business at Radico Khaitan Ltd., emphasized, “The key issue lies in the strict nomenclature and regulations. Revising these through ongoing negotiations to recognize our product as ‘Indian whisky’ would significantly enhance our market access.”

India is also advocating for similar relaxations in other markets, including the UK, where the minimum maturation period is three years. MRAs would be instrumental in expanding access to key markets like the UK, Canada, and Australia, where large Indian diasporas present significant growth opportunities for Indian whisky and rum.

Read More:

How can Indusfood boost Indian whisky’s global market access?

Indusfood will support the Indian whisky industry by creating opportunities for producers to connect with international buyers, address regulatory hurdles, and explore new markets. The event will showcase Indian whisky’s quality and potential, helping to overcome export challenges and enhance global market access.

© Trade Promotion Council of India. All Rights Reserved.