The global meat market has experienced significant growth in recent years, driven by a rising global population, urbanization, and increasing disposable incomes. Meat production is projected to rise from 218 million tonnes in 1997 to around 376 million metric tonnes by 2030. The market, valued at US$ 637.7 billion by 2029, is expanding at a 5.5% CAGR.

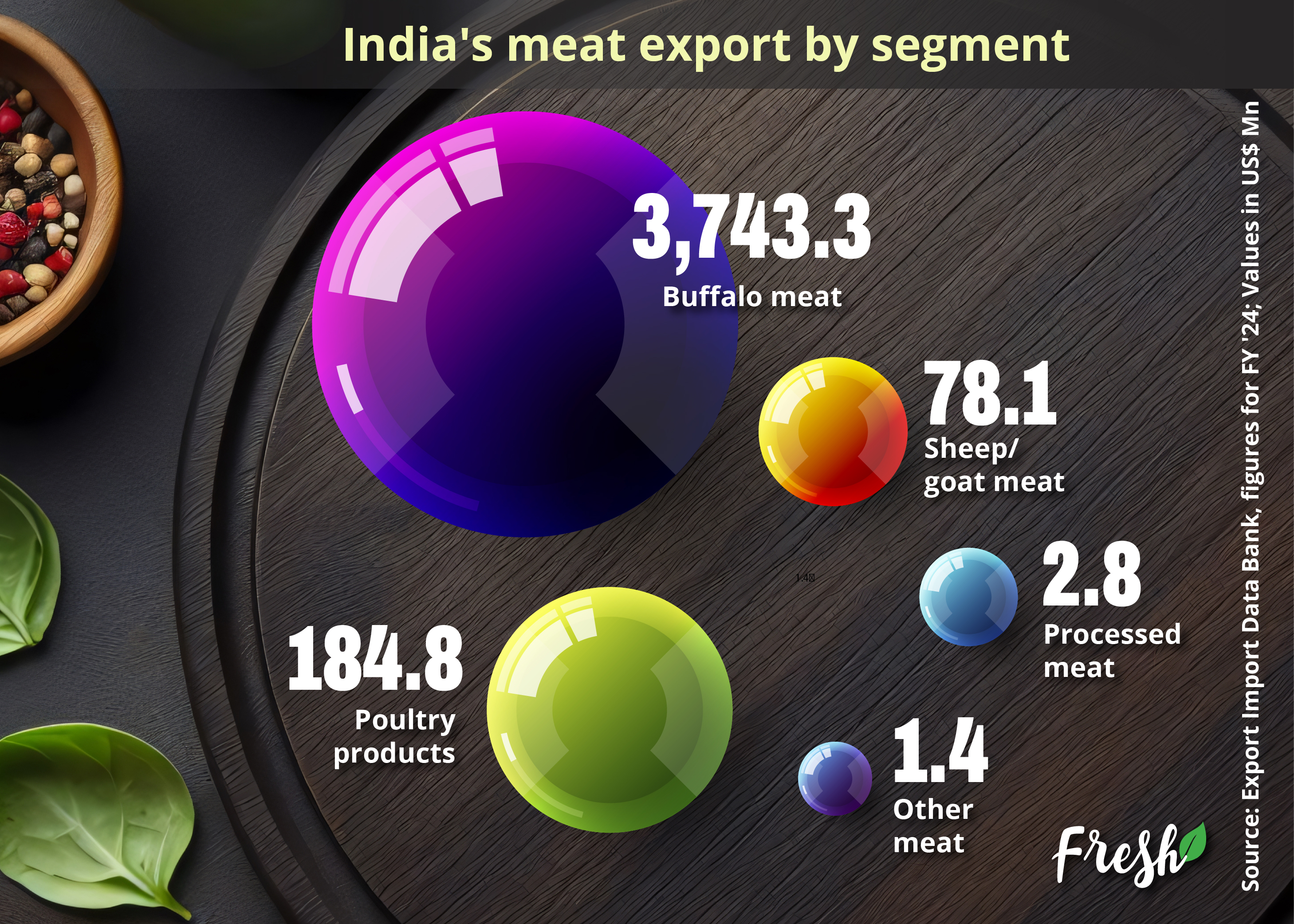

India, ranked third in egg production and eighth in meat production globally, has a rapidly expanding meat industry. While poultry leads the domestic market, India’s meat exports are led by buffalo meat. With rising domestic demand and increasing global exports, India’s meat industry is poised for continued expansion, driven by technology, consumer preferences, and international trade opportunities.

The global meat market has been showing significant growth in the recent few years, propelled by evolving consumer preferences, growing population, improving disposable incomes and rising urbanization. As an essential source of nutrition, meat consumption is increasing around the world, with annual global production expected to rise from 218 million tonnes in 1997 to around 376 million metric tonnes by 2030.

According to Mordor Intelligence, the global livestock and meat market is expected to reach US$ 637.7 billion by 2029, growing at a 5-year CAGR of 5.5%. When we look at trade figures, the global imports of raw meat reached US$ 161.2 billion in 2023, growing at a 5-year CAGR of 5.3%. Imports were led by China with a share of 16.6%, followed by US (7.7%) and Japan (6.1%). China’s imports are also growing at the fastest CAGR of 19.4% over five years, followed by Mexico (10.6%) and the US (8.1%). Imports of processed meat on the other hand had reached US$ 26.9 billion in 2023, growing at a 5-year CAGR of 4.4%.

India’s annual meat production was estimated at 9 million tonnes, while egg production surpassed 130 billion units in 2021-22. India’s raw meat exports reached a value of US$ 3.6 billion in 2023, growing by 12.1% YoY. According to the Food and Agriculture Organization’s FAOSTAT production data (2020), India ranks third in egg production and eighth in meat production globally.

Poultry has established itself as the fastest-growing meat segment, with a notable 26.8% increase in value during 2017-22, especially due to its affordability and widespread acceptance across various cultures. Beef was the second-fastest growing meat category, projected to expand at a CAGR of 1.89%. Poultry accounts for nearly 51.44% of total meat production in India, while buffalo, goat, sheep, pig, and cattle contribute 17.5%, 13.6%, 10.3%, 3.9%, and 3.2%, respectively.

India’s poultry industry has rapidly emerged as one of the fastest-growing producers worldwide, with production increasing four-fold over the past two decades. This growth has been marked by a gradual shift toward large-scale commercialization, navigating various challenges along the way.

According to the National Action Plan for Egg and Poultry – 2022 developed by the Department of Animal Husbandry, Dairying, and Fisheries, more than 80% of poultry output, particularly in the broiler segment, now comes from organized commercial farms. Leading poultry companies have vertically integrated their operations, making up 60-70% of the total poultry meat production. Consequently, India has become the third-largest egg producer and the sixth-largest producer of broiler meat globally.

The top five meat-producing states—Maharashtra (12.3%), Uttar Pradesh (12.1%), West Bengal (11.6%), Andhra Pradesh (11%), and Telangana (10.8%)—collectively contribute 57.9% of the nation’s total meat output.

The Indian edible meat market is currently valued at approximately US$ 14.4 billion in 2024 and is anticipated to grow to US$ 16.1 billion by 2029. From 2017-22, the market experienced a significant increase of 19.7%, largely fuelled by rising incomes, urbanization, and a burgeoning middle class. Despite around 20% of the population being vegetarian, awareness of the importance of protein intake is on the rise, further stimulating demand. Per capita meat consumption exceeds 4.9 kg, with a growing preference for processed options like salted and smoked products, enhancing taste and retaining quality.

The rising international demand for Indian buffalo meat has resulted in a significant boost in meat exports. Raw meat exports were valued at US$ 3.6 billion in 2023, growing by 12% YoY. Key markets for Indian raw meat include Vietnam (19.7% share), Malaysia (14.6% share), Egypt (13.7% share), Indonesia (8.4% share)and United Arab Emirates (7.7% share). India is ranked 14th in exports of this category.

Buffalo meat dominates India’s raw meat exports, valued at US$ 3.2 billion in 2023. India is the 4th largest exporter of frozen bovine meat (HS 02) exporter globally by value after Brazil, Australia and the US. On the other hand, there is significant untapped potential in the processed meat category. India’s exports in this category were valued at just US$ 2.4 billion in 2023, but with a strong YoY growth rate of nearly 50%.

The major drivers of growth in the Indian meat market are as follows:

The world’s population has grown to 8 billion as of November 2022, and is expected to reach 9.7 billion by 2050. Further, economic growth in emerging markets like China, India, and Brazil is boosting disposable incomes and expanding the middle class, which is increasingly willing to spend on protein-rich and high-quality food. As more individuals enter the middle class, the demand for high-quality and convenient meat options continues to surge, particularly in urban centers.

Technological advancements in meat processing and preservation have successfully addressed contemporary challenges and met evolving consumer demands. Innovations such as high-pressure processing (HPP), modified atmosphere packaging (MAP), and computer vision have significantly enhanced operational efficiency, safety, and product quality while reducing waste.

Additionally, precision meat grading and real-time monitoring systems have facilitated accurate quality control and improved traceability, fostering consumer trust. As the industry has adapted to rising health trends and sustainability concerns, these modern preservation techniques have proven vital in maintaining quality and extending shelf life.

As consumers prioritize healthier options, the demand for processed bovine products with lower fat, sodium, and additives is rising. Producers are responding by developing healthier alternatives, such as lean cuts and naturally preserved items. A report by Brandwatch noted that online search interest for “high protein” reached a five-year high in early 2023 and has remained elevated, with discussions about high protein increasing 32% year-over-year in May of that year. This is in line of the ever-rising protein consumption.

Urban consumers, who often lead busy lifestyles are fueling demand for convenient, ready-to-eat meat products, including single-serve portions, pre-cooked meals, and snack-sized options that fit their needs.

Diverse meat preservation techniques have significantly boosted the demand for fresh processed meat. Advanced cold chain solutions are essential for maintaining the value of perishable goods, particularly food. They help minimize food loss and reduce carbon emissions from waste, while also extending product shelf life and preserving nutritional value and flavour. These systems enhance food safety by preventing the growth of harmful bacteria and pathogens. Moreover, advanced cold chain technologies can decrease shipping costs and energy consumption, and data analytics can optimize operations by identifying trends and potential risks.

These advancements have fueled the trend toward convenience foods in the meat sector. These could include pre-cooked and frozen dishes featuring chicken or seafood, pre-packaged deli meats and chicken nuggets and seasoned or marinated meats.

Startups are reshaping the agri-food market by introducing innovative technologies, online models and sustainable practices that enhance efficiency and cater to consumer demand. Their agility fosters a culture of experimentation, while collaborations with larger companies expand their resources and market reach.

Notably, startups like FreshToHome, Licious, and Meatigo are transforming the meat trade in India, which primarily involves raw meat, by introducing wet meat to the markets with significant untapped potential.

Licious, for instance, employs a farm-to-fork approach, controlling its entire supply chain and cold chain to ensure product quality and freshness. It offers value-added services such as marination and ready-to-cook options, making it a comprehensive solution for meat and seafood needs. Additionally, it guarantees fast delivery within hours and provides a subscription model for convenient, scheduled orders.

However, this is just the tip of the iceberg. The online meat market is still at a size of Rs 2,500-3,000 crore (US$ 350 million), less than 1% of the overall meat and seafood market. These meat delivery startups are now expanding their reach to the offline mode. This goes to show the immense untapped potential in this market as far as India is concerned.

Read More:

How will Indusfood address the challenges and opportunities in rapidly expanding India’s meat industry?

Indusfood will support the growth of India’s meat industry by:

© Trade Promotion Council of India. All Rights Reserved.