India’s coffee culture is experiencing a dynamic transformation, evolving into a vibrant lifestyle choice shaped by a rising demand for quality, sustainability, and artisanal experiences. With the coffee market valued at approximately US$ 1.81 billion in 2023 and projected to reach US$ 2.43 billion by 2030, the country stands as the sixth-largest coffee producer globally. Major players like Blue Tokai and Third Wave Coffee Roasters are redefining the cafe experience, catering to younger generations seeking unique flavours and collaborative workspaces.

As innovations such as cold brews and ready-to-drink options emerge, the coffee scene is thriving alongside a passionate community of consumers who value ethical sourcing and sustainability.

India’s coffee culture is like a rich blend of tradition and new-age trends, offering something for everyone. From the comforting filter coffee of South Indian households to the bustling cafes in cities. Coffee has become more than just a drink; its where people connect, brainstorm, or simply take a break.

Young Indians, especially Gen Z and millennials, are driving this love for coffee, not just for its taste but for the entire experience.

Local brands like Blue Tokai and Third Wave Coffee are making it exciting with fresh brews and cosy cafe vibes, while global chains add a touch of familiarity and glamour. Whether it’s a quick cup before work or a long catch-up session with friends, coffee is now an essential part of our lifestyle.

Coffee’s journey in India began with the legendary story of Baba Budan, a Sufi saint who, in the 17th century, smuggled seven coffee beans from Yemen into India. He planted these beans in the lush Baba Budan Hills near Chikkamagaluru, Karnataka, setting the stage for what would blossom into one of the country’s beloved agricultural staples.

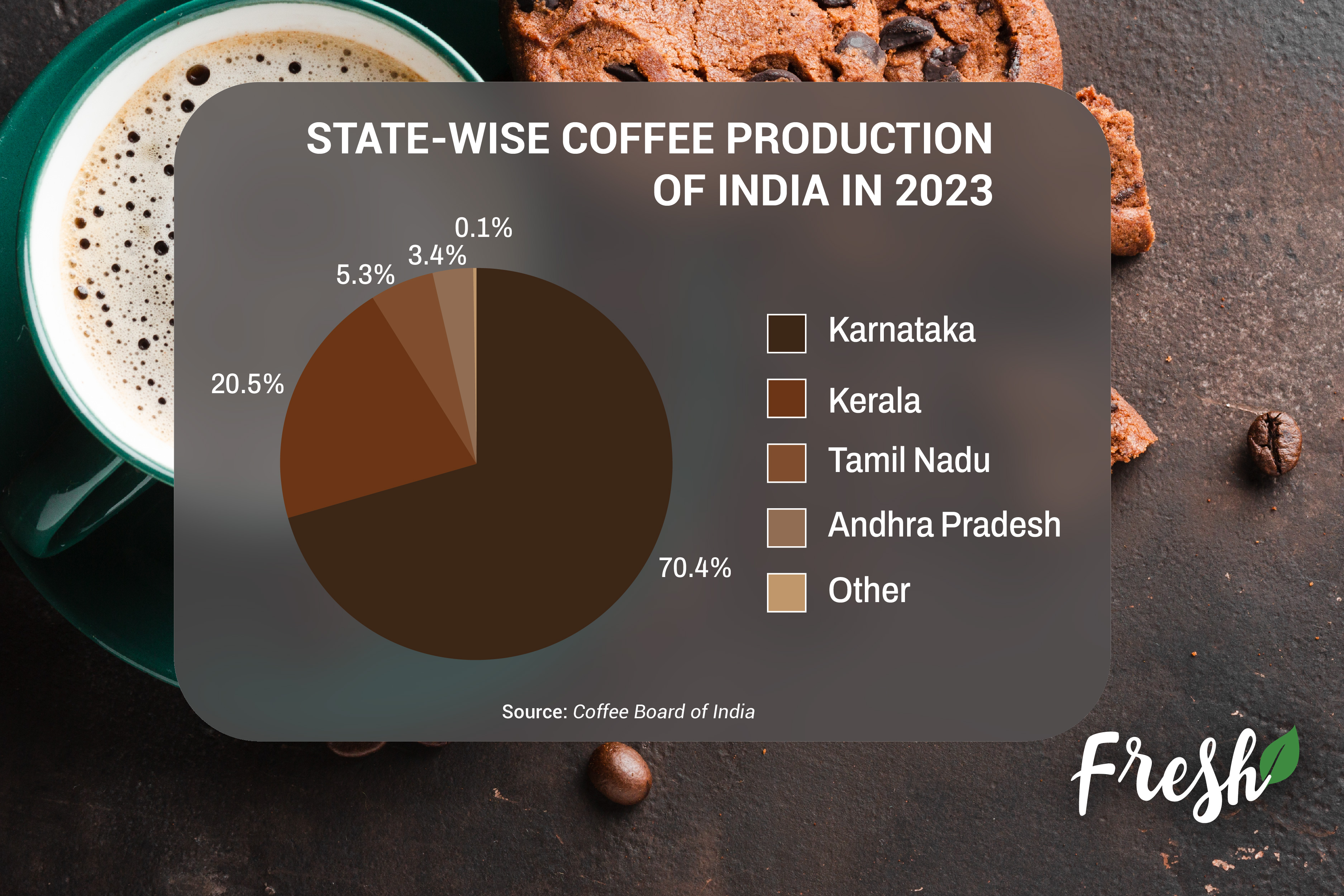

Today, Karnataka stands as the heart of Indian coffee production, contributing over 70.5% of the country’s coffee output. The country produces both Arabica and Robusta beans, giving it a diverse flavour profile that caters to changing tastes in both domestic and international markets.

India’s Coffee Production

India stands as the sixth-largest coffee producer globally. India produces about 352,000 metric tonnes of coffee (2022-23), of which over 70% is Robusta and the rest 30% is Arabica, the two main varieties. Arabica coffee is known for its smooth and fragrant qualities, meanwhile, Robusta is famous for its stronger flavour and higher caffeine content.

| Production of coffee in major states of India | ||||||

| State | Post Blossom Estimate 2023-2024 | Final Estimate 2022-2023 | ||||

| Arabica | Robusta | Total | Arabica | Robusta | Total | |

| Karnataka | 81,960 | 184,925 | 266,885 | 72,020 | 176,000 | 248,020 |

| Kerala | 2,075 | 70,750 | 72,825 | 1,975 | 70,450 | 72,425 |

| Tamil Nadu | 13,045 | 5,390 | 18,435 | 13,250 | 5,450 | 18,700 |

| Andhra Pradesh | 15,340 | 40 | 15,380 | 12,225 | 40 | 12,265 |

| Orissa | 500 | 0 | 500 | 465 | 0 | 465 |

| North Eastern Region | 80 | 95 | 175 | 65 | 60 | 125 |

| Grand Total (India) | 113,000 | 261,200 | 374,200 | 100,000 | 252,000 | 352,000 |

Out of the 3.5 lakh tonnes of coffee India produces, Karnataka is responsible for 70.5%, followed by Kerala (20.5%), Tamil Nadu (5.3%), Andhra Pradesh (3.4%), Orissa (0.1%), and the North Eastern region (0.04%), or 2.5 lakh tonnes, which is grown on approximately 2.4 lakh hectares.

The ideal temperature for arabica is 22 °C, while it is a little higher for robusta, at 27 °C, making elevated areas like Chikkamagaluru, Hassan, and Kodagu in Karnataka suitable for its cultivation.

According to Dr. M. Senthilkumar, Director of Research at the Coffee Board of India, “by embracing nature’s rhythms and refining our cultivation practices, we unlock the potential for producing coffee that captivates the world. The resilience of shade-grown coffee, combined with India’s biodiversity, ensures our position as a leader in quality and sustainability.”

Today, the global coffee market is substantial and rapidly growing. It was valued at approximately US$ 132.1 billion in 2024, projected to reach US$ 166.4 billion by 2029, exhibiting a CAGR of 4.72% from 2024- 29.

Similarly, Indian coffee market size was valued at US$ 1.81 billion in 2023, expected to reach 2.43 billion by 2030, growing at a CAGR of 4.3% from 2024-30. Demand for coffee continues to rise, particularly as millennials and Gen Z exhibit a preference for unique flavours and sustainable sourcing practices.

In India’s vibrant coffee market, several key brands are making significant strides and reshaping consumer perceptions. Starbucks has become a household name, focusing on quality and community engagement. Nescafe, with its instant coffee formats, continues to dominate both urban and rural consumers. Bru, owned by Hindustan Unilever, is known for its range of instant coffee products, especially popular in South India.

Blue Tokai prioritises high-quality, freshly roasted beans sourced directly from farmers and emphasises transparency and sustainability. Third Wave Coffee Roasters focuses on quality and community, rapidly expanding its cafe presence. Whereas Sleepy Owl has carved a niche with its innovative cold brew and brewed coffee bags, appealing particularly to younger consumers seeking convenience without sacrificing quality.

Finally, Araku Coffee stands out for its organic cultivation practices and community impact, garnering international acclaim for its unique flavour profile, cultivated by tribal farmers in the picturesque Araku Valley. More and more consumers are opting for cold brews, micro-lot coffees, and exploring home brewing options, reflecting a shift towards personalised coffee experiences.

Cafes are no longer merely places to grab a cup; they have become vibrant hubs for socialising, networking, and even conducting business meetings. Establishments like The Kind Roastery and Subko are tailored to attract this generation. The rise of co-working spaces further amplifies this trend, as many Gen Z workers seek flexible work environments that cater to their lifestyle preferences.

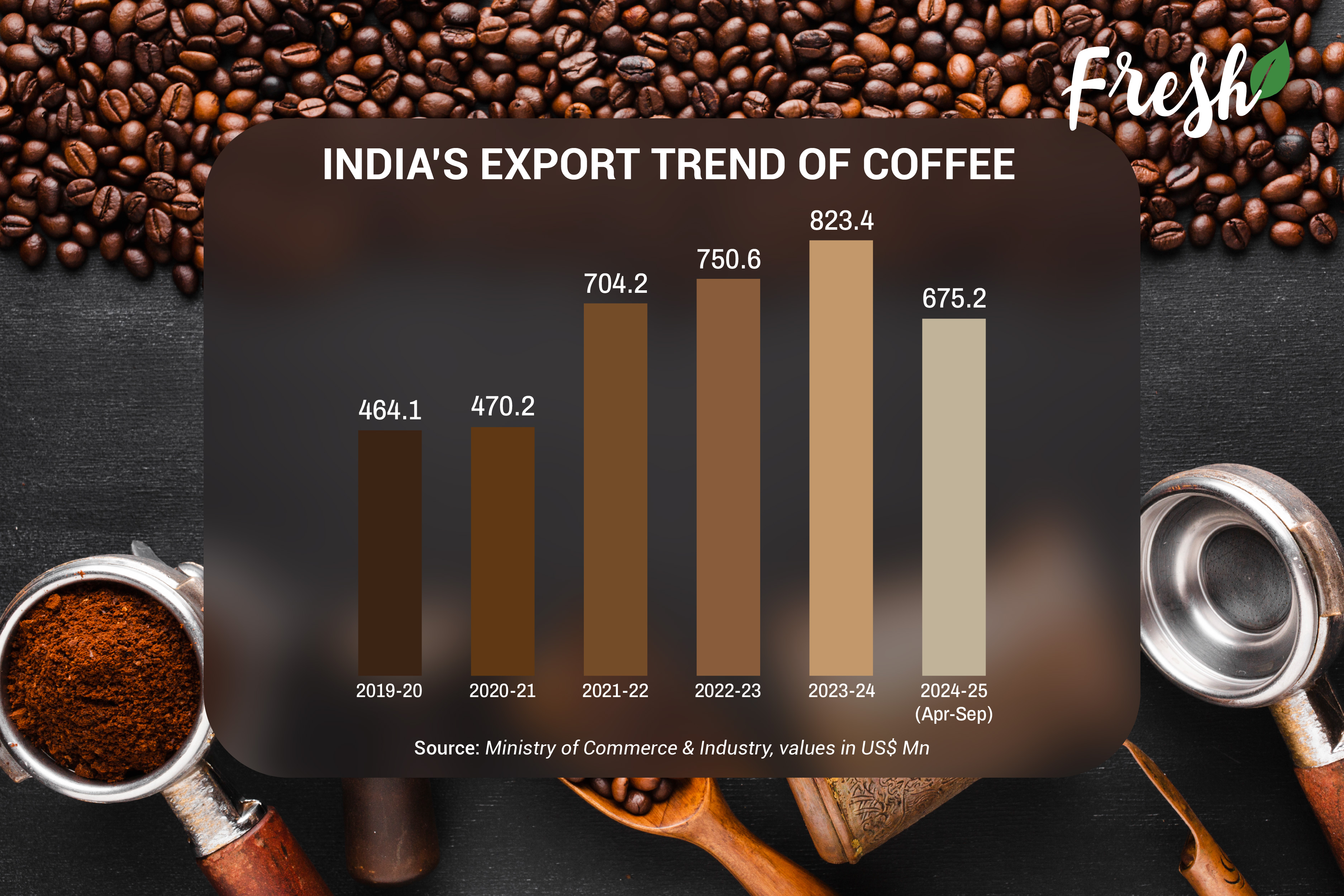

India exports 70% of its total production of coffee. According to data from the Ministry of Commerce and Industry, coffee exports accounted for US$ 823.4 million in 2023-24, growing at 9.7% YoY. India’s coffee exports are growing at a CAGR of 9.2% from 2018-19 to 2023-24.

Italy is the largest importer of coffee from India, worth US$ 196.4 million with a 23% share in 2023-24, followed by Germany (US$ 121.3 million), Belgium (US$ 61.3 million), the UAE (US$ 48.8 million), and Jordan (US$ 40.6 million), which are the prime buyers of Indian coffee.

Rajat Luthra of Third Wave Coffee adds, “Our expansion into newer markets only further fuels the growth of the coffee-at-home culture. Consumers appreciate the ability to recreate a cafe experience in their own kitchens, and we have enabled this through products like our Easy coffee bags and speciality brewing equipment, easily accessible through websites and platforms like Amazon.”

Looking ahead, the future of coffee in India appears promising. The drive toward sustainability will shape production practices and consumer habits, with a focus on ethical sourcing and organic certification. As environmental concerns grow, consumers are leaning towards brands that can demonstrate commitment to sustainability, making it essential for producers to adopt greener practices.

M.B. Ganapathy, Executive Vice President at Tata Coffee Limited, said, “Indian coffee stands as a global symbol of quality, nurtured under shade-grown systems that preserve biodiversity and deliver exceptional flavors. With the domestic coffee market to global exports, there are abundant opportunities for Indian coffee manufacturers, but we have to ensure that Indian coffee is produced in harmony with nature.”

Events such as coffee festivals, tasting sessions, and workshops have become increasingly popular, drawing enthusiasts eager to learn more about coffee origins, brewing methods, and flavour profiles. Coffee is becoming synonymous with social connectivity as people bond over shared experiences in local cafés or artisanal coffee houses.

Read More:

How is Indusfood supporting the growth of India’s coffee industry?

Indusfood serves as a vital platform for the Indian coffee industry by connecting producers, exporters, and buyers from across the globe. The event highlights India’s premium coffee offerings, including shade-grown Arabica and robust Robusta varieties, through dedicated pavilions and showcases. Coffee brands like Araku Coffee, Blue Tokai, and Third Wave Coffee Roasters gain exposure to international markets, fostering collaborations and boosting exports.

Additionally, Indusfood provides opportunities for knowledge sharing and networking through workshops, discussions, and B2B meetings. This empowers stakeholders to explore sustainable practices, tap into evolving consumer preferences, and embrace innovations, thus strengthening India’s position in the global coffee market.

© Trade Promotion Council of India. All Rights Reserved.