Fertilizers are vital to India’s agriculture, which contributes 18% to GDP. The Indian fertilizer industry, valued at ₹982 billion in 2024, is expected to reach ₹1,401 billion by 2033, driven by rising demand and government support. Chemical fertilizers dominate, especially for grains, with North India leading the usage. Despite growth in production and exports, India relies heavily on imports for key nutrients. While infrastructure gaps, subsidy burdens, and environmental concerns challenge the sector, opportunities lie in sustainable practices, precision farming, customized nutrients, and digital platforms, supported by government policies and industry innovation.

Agriculture accounts for 18% of India’s GDP, with fertilizers playing a vital role in enhancing productivity and supporting economic growth. As one of the world’s largest fertilizer consumers, India depends on these inputs to meet crop nutrient requirements and ensure food security for its expanding population. The country’s agricultural reliance and varied agro-climatic zones drive diverse fertilizer demand.

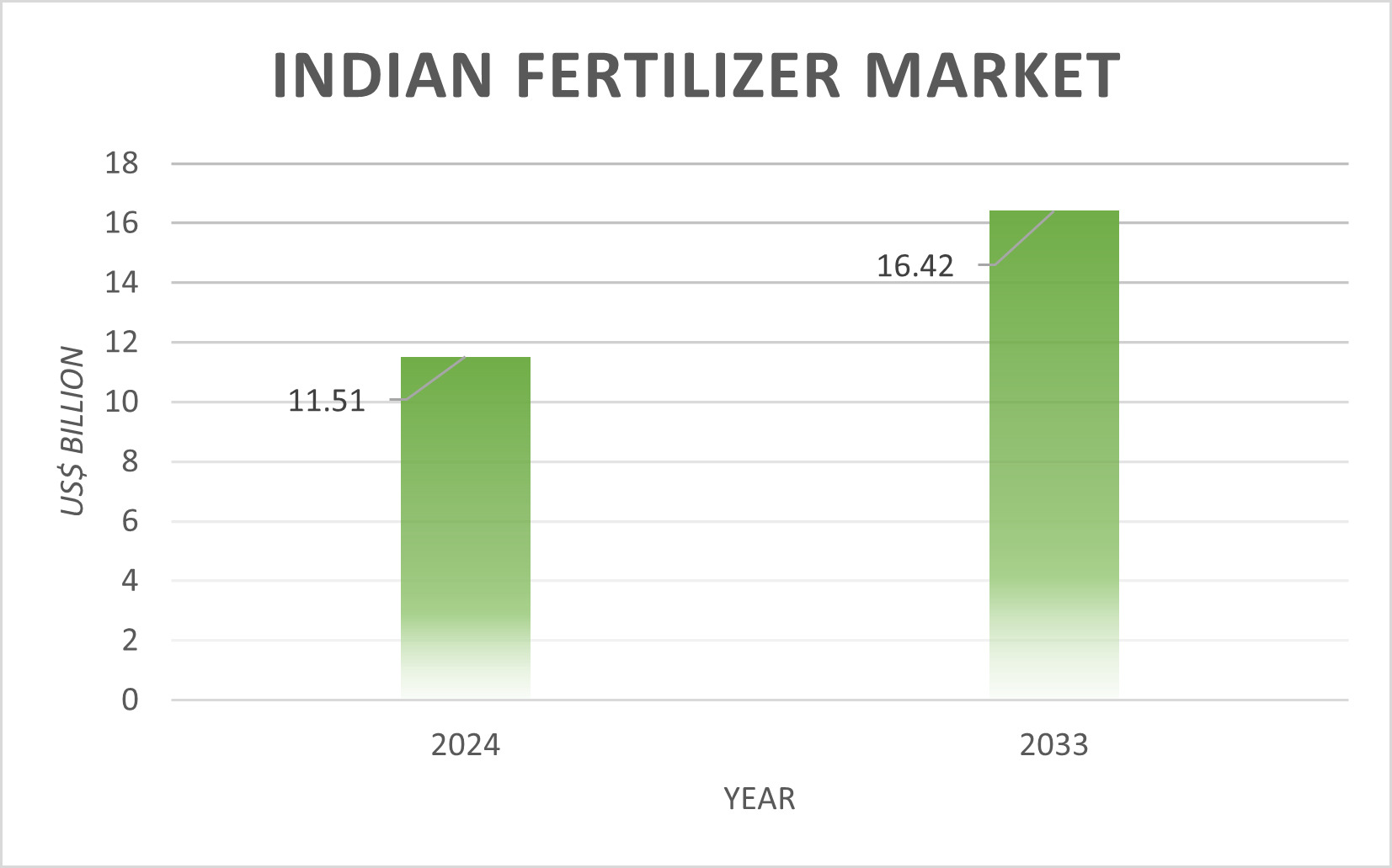

According to Indian Fertilizer Market Report (2025-2033) by IMARC Group, the Indian fertilizer market was valued at Rs 982.00 billion (US$11.51 billion @ ₹85.3163/US$) in 2024. The market is expected to grow at a CAGR of 4% between 2025 and 2033, reaching Rs 1,401.00 billion (US$16.42 billion) by 2033.

Fertilizers are vital to enhancing agricultural productivity, especially for key crops like rice, wheat, sugarcane, and vegetables. They help increase yields, improve produce quality, and replenish soil nutrient deficiencies.

The Indian fertilizer industry is segmented by type, form, application mode, crop type, and region.

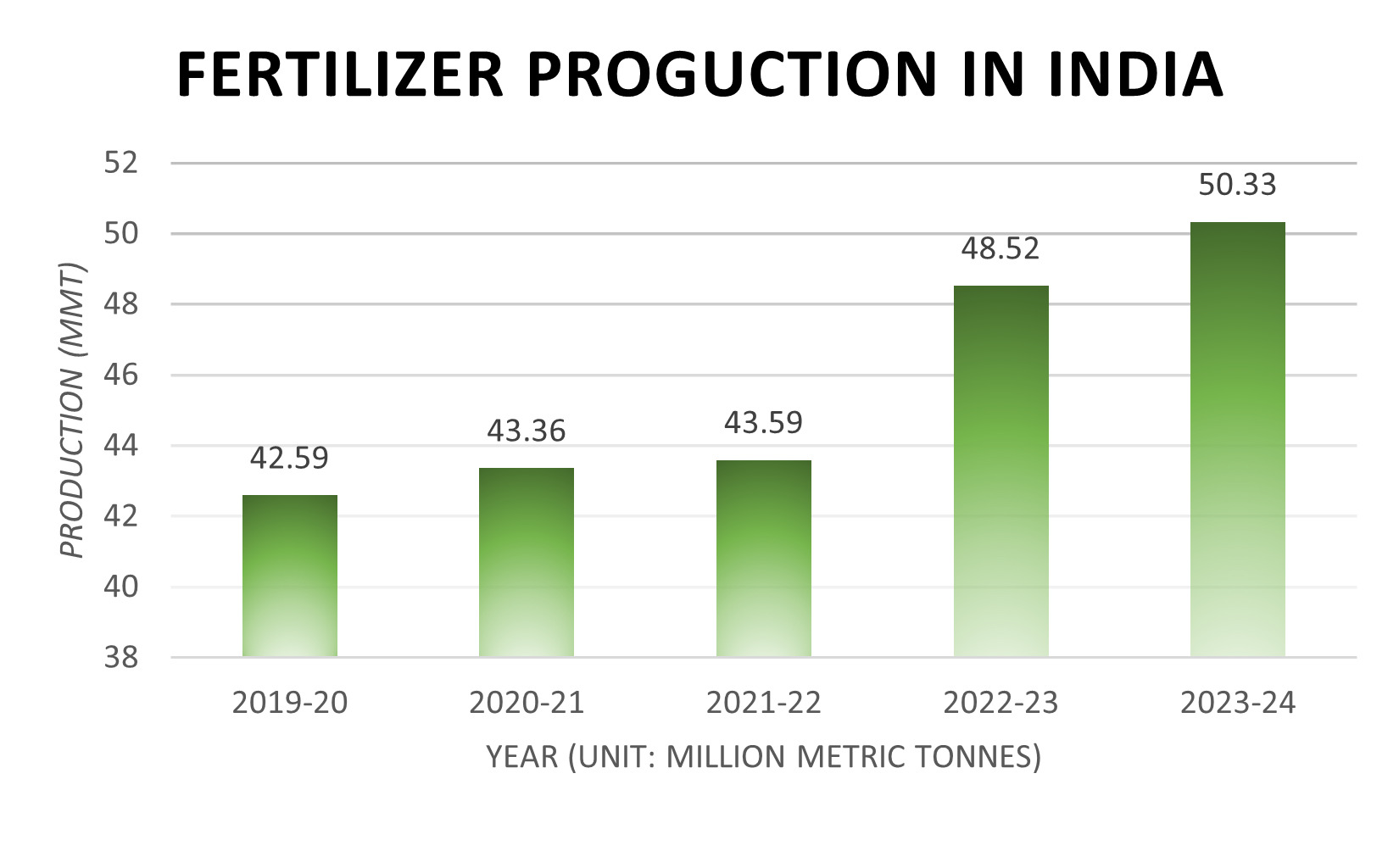

India’s fertilizer production has seen consistent growth in recent years, driven by government initiatives and a focus on self-reliance. Among eight core industries (Coal, Crude Oil, Natural Gas, Refinery Products, Fertilizers, Steel, Cement), the growth in fertilizer production was at 3.7% during 2023-24, compared to 2022-23.

India’s fertilizer production grew to 503.35 lakh tonnes (50.33 MMT) in the 2023-24 financial year. The total fertilizer production in India has increased steadily during the past five years. It was 425.95 lakh tonnes (42.59 million metric tonnes (MMT)) in 2019-20; 433.68 lakh tonnes (43.36 MMT) in 2020-21; 435.95 lakh tonnes (43.59 MMT) in 2021-22; 485.29 lakh tonnes (48.52 MMT) in 2022-23.

India is the world’s second-largest consumer of fertilizers with an annual consumption exceeding 55 million tons.

Fertilizer consumption, in terms of nutrients (N + P₂O₅ + K₂O) is estimated at 30.64 million metric tonnes (MT) for 2023-24, reflecting a 2.7% increase compared to 2022-23. During this period,

In terms of fertilizer products, all-India estimated consumption during 2023-24 stood at:

However, consumption of Single Super Phosphate (SSP) declined by 9.4% to 4.54 million MT. The total consumption of all fertilizer products during 2023-24 was 64.84 million MT, marking a 1.6% rise over the previous fiscal year.

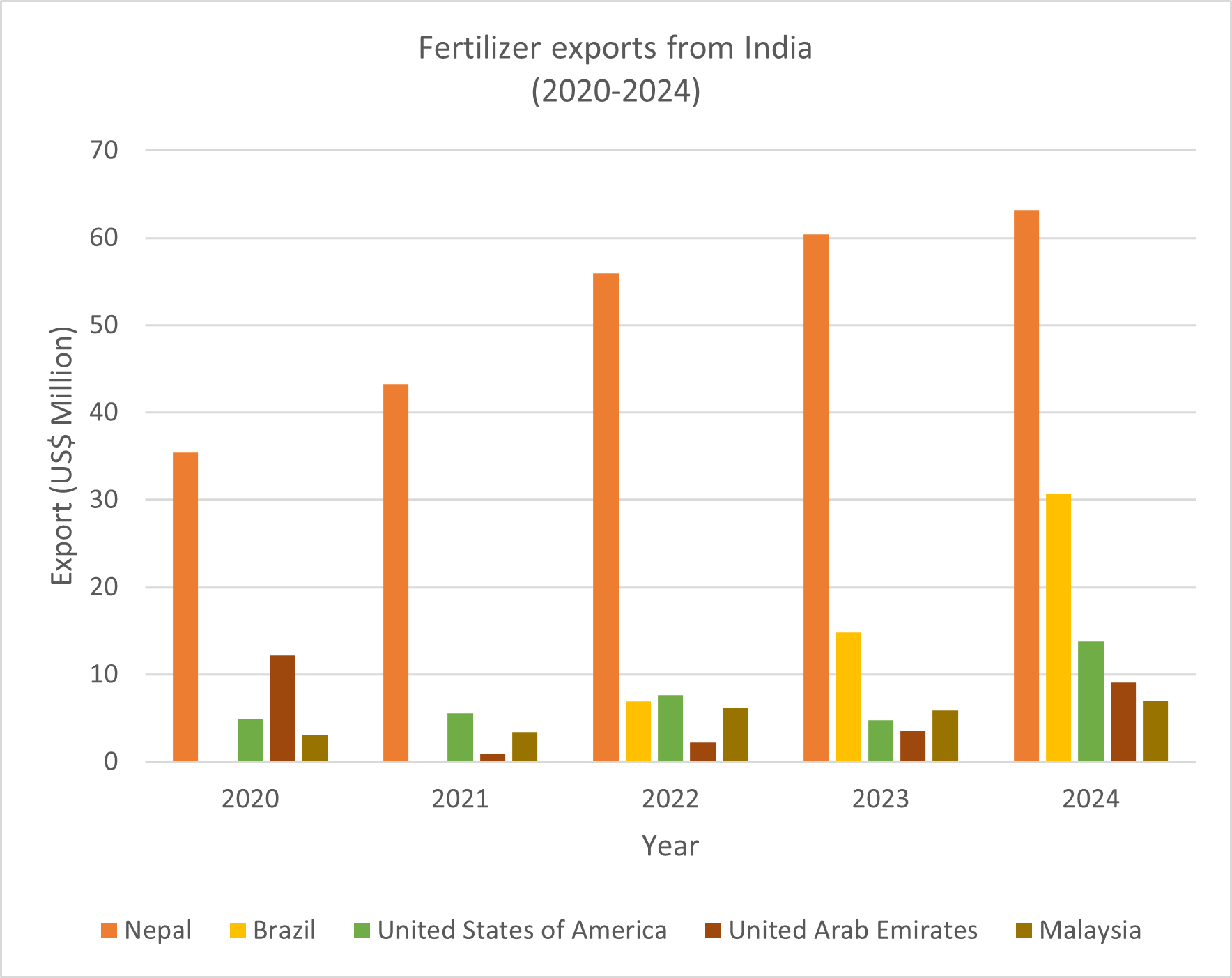

India, with its rich agricultural legacy, is also an exporter of fertilizers. The growing global demand for high-yield and sustainable farming practices has boosted the popularity of Indian fertilizers in international markets.

The fertiliser exports from India have been growing steadily over the years. The top fertilizers exported from India are Urea, diammonium phosphate (DAP), NPK Fertilizers, Single Super Phosphate and Potassium Fertilizers.

Table: Fertilisers exported by India

| HS Code | Product | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|

| 3105 | Mineral or chemical fertilisers containing two or three of the fertilising elements nitrogen, . . . | 48.10 | 42.43 | 22.73 | 39.79 | 67.75 |

| 3103 | Mineral or chemical phosphatic fertilisers (excl. those in tablets or similar forms, or in . . . | 5.46 | 2.24 | 11.98 | 15.21 | 32.16 |

| 3102 | Mineral or chemical nitrogenous fertilisers (excl. those in tablets or similar forms, or in . . . | 37.59 | 21.15 | 54.04 | 43.11 | 32.13 |

| 3101 | Animal or vegetable fertilisers, whether or not mixed together or chemically treated; fertilisers . . . | 12.85 | 16.61 | 25.62 | 16.58 | 31.23 |

| 3104 | Mineral or chemical potassic fertilisers (excl. those in tablets or similar forms, or in packages . . . | 13.82 | 2.53 | 2.95 | 8.35 | 9.76 |

Major export destinations include Nepal, Brazil, USA, UAE, Malaysia, Mozambique, Sri Lanka, China, Oman and Kenya. In 2024, Nepal, Brazil, USA, UAE and Malaysia were key importers of fertilizers exported from India.

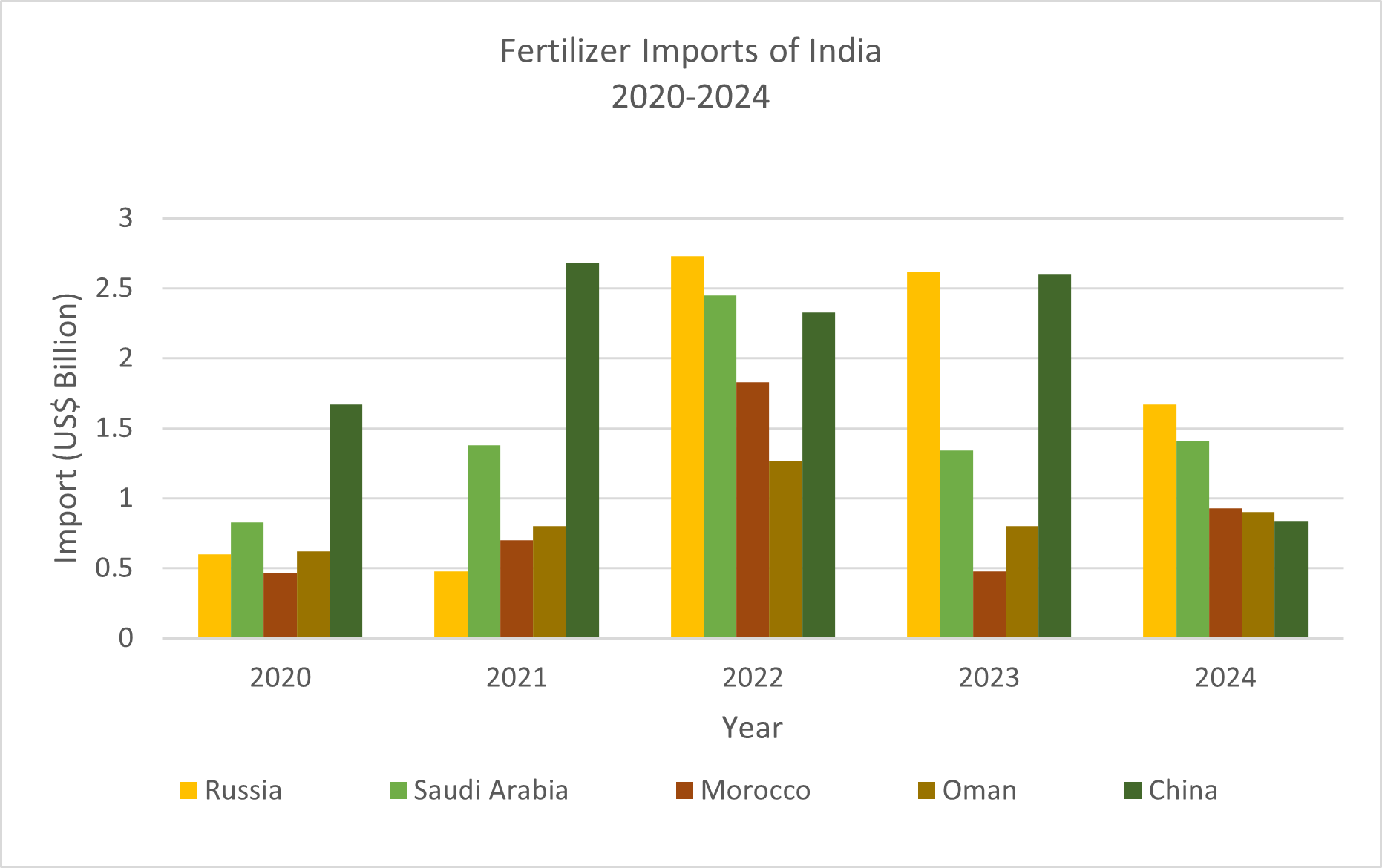

Although exports are steadily increasing, India continues to depend significantly on fertilizer imports to meet its agricultural needs, particularly for essential nutrients like potash, phosphorus, and certain nitrogen-based fertilizers. This dependency stems from several factors, including:

India imports fertilizers primarily to meet domestic demand for essential nutrients. Russia, China, Morocco, Oman, and Saudi Arabia are among the major suppliers of fertilisers to India.

Table: Trend in Import of Fertilizers

| Year | Type of Fertilize (Figures in LMT) | ||||

| Urea | DAP | *MOP | NPKS | Total | |

| 2018-19 | 74.81 | 66.02 | 42.14 | 5.46 | 188.43 |

| 2019-20 | 91.23 | 48.7 | 36.7 | 7.46 | 184.09 |

| 2020-21 | 98.28 | 48.82 | 42.27 | 13.9 | 203.27 |

| 2021-22 | 91.36 | 54.62 | 24.6 | 11.7 | 182.28 |

| 2022-23 | 75.8 | 65.83 | 18.66 | 27.52 | 187.81 |

| 2023-24 | 70.42 | 55.67 | 28.69 | 22.17 | 176.95 |

Source: ITC Trade map

However, during 2023–24, urea imports declined by 7.1% compared to 2022–23, primarily due to increased domestic production from five newly commissioned plants. Imports of DAP and NP/NPK complex fertilizers also saw a significant drop of 15.4% and 19.4%, respectively, mainly attributed to elevated international prices of phosphatic fertilizers. In contrast, MOP imports registered a notable rise of 53.8% during the same period. The total import volumes in 2023–24 stood at:

Major challenges confronting the Fertilizer Industry in India

Import Dependency: India’s fertilizer industry faces a critical challenge due to its heavy dependence on imported raw materials, particularly potash and phosphates. This reliance makes the sector susceptible to global market fluctuations. Events such as geopolitical conflicts or disruptions in international supply chains can lead to increased costs and unpredictable availability of fertilizers. As a result, farmers may struggle to access fertilizers at affordable prices, which can negatively impact crop yields and overall agricultural productivity.

Subsidy Burden: The Indian government offers substantial fertilizer subsidies to ensure affordability for farmers, particularly those who are small and marginal. While these subsidies are essential for supporting the agricultural community, they impose a significant financial burden on the government. Furthermore, the subsidy system encourages the overuse and misuse of fertilizers, leading to soil degradation and environmental harm, which undermines the sustainability of farming in the long run.

Imbalanced Fertilizer Use: In India, farmers often rely too heavily on nitrogen-based fertilizers like urea, while neglecting the use of phosphates and potash. This imbalance leads to the depletion of crucial soil nutrients, which over time reduces crop yields. Furthermore, it contributes to environmental problems, such as water contamination and higher greenhouse gas emissions, posing a challenge to sustainable farming practices.

Insufficient Infrastructure: The fertilizer distribution network in India is often inefficient, characterized by insufficient storage facilities and inadequate transportation systems. These issues can cause delays in fertilizer delivery, particularly during key planting seasons. Additionally, the lack of proper infrastructure contributes to significant post-harvest losses and fertilizer wastage, further hindering the overall efficiency of the agricultural supply chain.

Regulatory Challenges: The Indian fertilizer industry is subject to strict regulations governing pricing, distribution, and manufacturing. While such measures are essential for maintaining quality and safeguarding against exploitation, excessive bureaucracy and complex procedures can hinder innovation and reduce the industry’s overall efficiency.

Environmental Concerns: Excessive use of chemical fertilizers has contributed to serious environmental issues such as declining soil health, water pollution, and reduced biodiversity. Adopting sustainable farming practices is crucial to address these challenges and preserve agricultural productivity for the future.

The Indian fertiliser industry is poised for significant growth, driven by government support, technological advancements, and a shift towards sustainable practices. Here’s an overview of the key opportunities:

Government Support and Subsidies

Sustainable and Green Fertilisers

Technological Advancements

The move toward customized fertilizers tailored to specific soil and crop requirements presents another growth avenue. Ongoing research and development into high-efficiency fertilizers that minimize nutrient loss and environmental harm is shaping the industry’s future. Digital platforms are further streamlining the fertilizer supply chain. Tools like IFFCO’s ‘iMandi’ connect farmers with agri-inputs and advisory services, enhancing accessibility and convenience. Sustainable production methods, such as utilizing waste materials and industrial by-products, are also gaining momentum.

Moreover, investors can explore opportunities in fertiliser stocks, with companies like Chambal Fertilisers, Coromandel International, and Rashtriya Chemicals & Fertilizers showing potential. These companies are focusing on sustainable practices and expanding their product portfolios.

India, the world’s second-largest fertiliser consumer with annual usage surpassing 55 million tons, presents a significant investment opportunity in the Fertilisers and Pesticides sector.

The leading players in the Indian Fertilizer market include:

India’s fertilizer industry is vital for sustaining agricultural productivity and food security. While facing challenges like import dependence, infrastructure gaps, and environmental concerns, the sector holds strong growth potential through innovation, sustainable practices, and government support. With rising demand and evolving market dynamics, the industry is poised for transformation toward greater efficiency, self-reliance, and long-term sustainability.

Read More :

© Trade Promotion Council of India. All Rights Reserved.