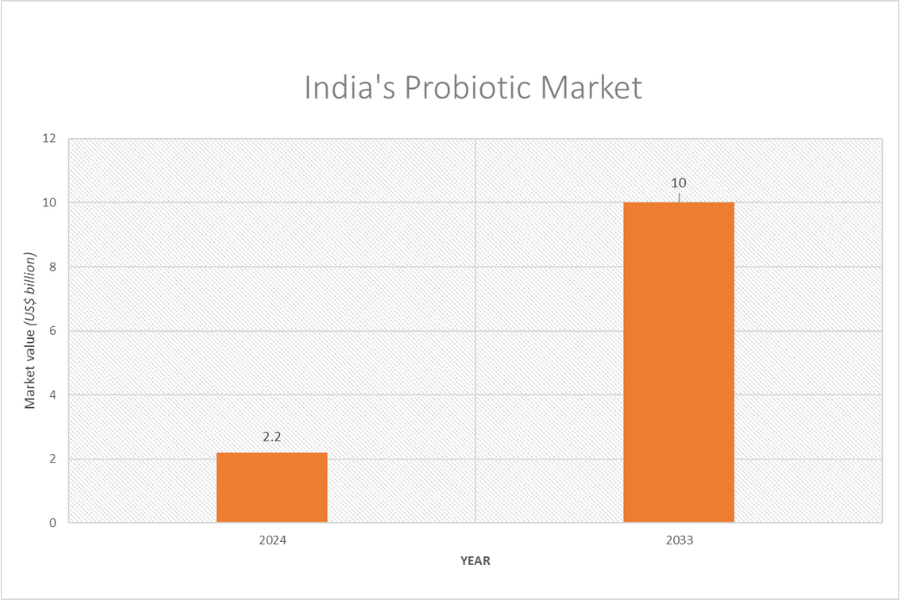

India’s probiotics market is growing rapidly due to increasing digestive disorders, lifestyle-related health concerns, and post-pandemic immunity awareness. Valued at US$ 2.2 billion in 2024, it is projected to reach US$ 10 billion by 2033.

Consumers are shifting toward functional foods and supplements, with rising demand for plant-based, dairy-free, and sugar-free probiotic options. Urbanization and busy lifestyles are fuelling interest in convenient, ready-to-consume probiotic products. Women’s health is emerging as a key focus, with targeted strains gaining traction. E-commerce and D2C platforms are making probiotics more accessible. Innovations like personalised blends and shelf-stable formats are expanding the market. However, challenges such as high costs, regulatory gaps, low rural awareness, and cold-chain limitations persist across India.

Probiotics are becoming an essential component of the Indian diet as more consumers look to enhance digestion, strengthen immunity, and support overall gut health. The Indian probiotics market is experiencing robust growth, driven by rising concerns about gastrointestinal disorders and increasing awareness of the health benefits of probiotics—particularly their role in digestive and immune wellness.

An expanding elderly population, which is more vulnerable to chronic digestive issues, is contributing significantly to this trend. Simultaneously, a shift away from calorie-rich foods toward functional, health-enhancing alternatives is accelerating demand for probiotic-infused products.

The rise in working women and a growing emphasis on women health have led to the uptake of specialized probiotic strains like Lactobacillus acidophilus, L. rhamnosus, and Bifidobacterium, which are commonly used in formulations that support hormonal balance and digestive health.

Urbanization and busy lifestyles are also fuelling the popularity of convenient, ready-to-consume probiotic products such as curd, yogurt, and probiotic drinks—now increasingly available in portable and flexible packaging. Meanwhile, innovations like allergen-free, dairy-free, and sugar-free probiotics options are making it more accessible to a wider range of consumers. Additionally, the expanding Indian nutraceutical industry is reinforcing this momentum through greater investment in probiotic supplements and fortified food offerings.

1. By Application / Product Category

2. By Form/format

3. By strain/type:

Common bacterial genera:

4. By end‑user or demographic

5. By distribution & channels

6. By region

The COVID-19 pandemic has heightened consumer awareness around immunity, leading to a surge in demand for dietary supplements enriched with probiotic strains. Simultaneously, the growing influence of media, healthcare providers, and lifestyle coaches is encouraging individuals to adopt functional foods like probiotics as part of their daily nutrition. This broader cultural shift toward health and wellness is a key driver of the rapid expansion of the probiotics market in India.

The probiotics market in India was valued at US$ 2.2 billion in 2024. According to the IMARC Group, the market is expected to grow at a CAGR of 17.8% from 2025 to 2033, reaching approximately US$ 10.0 billion by 2033.

According to market research firm PharmaTrac, the probiotics market recorded a robust 22% growth in Moving Annual Total (MAT) for May 2025. Data indicates the market has expanded significantly, nearly doubling– from a MAT value of ₹1,016 crore (US$ 0.12 billion at ₹83/US$) in 2021 to ₹2,070 crore (US$ 0.25 billion) in 2025.

The Indian probiotics market is expected to maintain its growth momentum, fuelled by growing consumer awareness, advancements in product formulations, and a rising incidence of lifestyle-related health conditions.

Probiotics in everyday foods: The Indian market is seeing a strong push toward incorporating probiotics into daily food items. In 2024, over 300 new probiotic-enhanced products—ranging from snacks and juices to cereals—were launched, making it easier for consumers to adopt probiotics as part of their regular diet.

Rising demand for plant-based probiotics: The demand for plant-based probiotics is on the rise, driven by the growth of vegan lifestyles and increased lactose intolerance. According to a report by Ken Research, sales of these products in 2024, climbed to Rs 500 million, a sharp increase from previous years. Made from soy, almond, and coconut, these offerings are tailored to meet the evolving dietary preferences of Indian consumers.

Shift towards functional foods: Consumers are increasingly moving away from high-calorie diets and turning to functional foods and beverages, which is boosting the demand for probiotics.

Focus on women’s health: The growing number of working women and greater emphasis on women’s health are driving the uptake of targeted probiotic strains such as L. acidophilus, L. rhamnosus, and Bifidobacterium.

Rising demand for convenience products: Busy lifestyles and sedentary habits are increasing the popularity of ready-to-eat probiotic options like curd, yogurt, and drinks, especially in portable, easy-to-store, and flexible packaging.

Growth of the Indian nutraceutical Market: The expanding Indian nutraceutical industry and rising demand for dairy-free, allergen-free, and sugar-free probiotic formulations are positively impacting the market.

Post-pandemic health focus: Following the COVID-19 pandemic, consumer interest in immunity boosters, fortified foods, and dietary supplements has surged, further driving the growth of the Indian probiotics market.

Rise of e-commerce and D2C channels: E-commerce and direct-to-consumer channels have revolutionized the distribution of probiotics in India by making a diverse range of products easily accessible online. These platforms offer personalized shopping experiences with detailed product information and educational content, allowing consumers to make informed choices. Additionally, direct interactions through DTC models enable brands to customize products and gather valuable customer feedback, all supported by rising internet penetration and digital literacy.

Growing consumer awareness: The growing promotion of gut health and probiotics by health influencers, celebrities, and wellness advocates in the media is driving greater consumer awareness. This has inspired many individuals to explore probiotic-rich foods as part of their daily diet. Additionally, the wider availability of international probiotic brands and a surge in advertisements highlighting their benefits have further strengthened their acceptance and popularity among Indian consumers.

The probiotic sector is also emerging as a hotbed of innovation. Some of the latest probiotic innovations recently launched in India are as below:

MicrobioTx- Hyper‑Personalised Probiotics: A Bengaluru-based startup launched Personal Probiotics, India’s first tailored pre‑ and probiotic blend, formulated based on individual gut profiles. Rolled out on World Microbiome Day (June 27, 2024), this offering also debuted GutChat, a dedicated gut-health chatbot to support personalized wellness.

The Good Bug — GLP‑1 Probiotic Combo for Weight Management: Mumbai-based The Good Bug introduced (in Apr 2025) a probiotic + metabolic fibre capsule aimed at stimulating natural GLP‑1 (a hormone involved in appetite and glucose regulation). A 15‑day kit includes 16 billion CFU probiotics and 7 g fibre; a 90‑day clinical trial showed ~12% weight loss and 9.6% waist reduction (priced at around ₹2,000/month).

MilkyMist — Shelf‑Stable Probiotic Buttermilk: MilkyMist, with SIG and AnaBio, launched the first long‑life probiotic buttermilk in aseptic carton packaging (Nov 2024). Unlike traditional refrigerated drinks, this shelf-stable version maintains probiotic viability through mild aseptic processing.

Yakult Light Mango Flavour: Yakult Danone India launched a new mango-flavored probiotic drink variant on July 25, 2024. It contains the same Lactobacillus casei Shirota strain (650 crore CFU) as the original, offering consumers a familiar probiotic in a more tropical flavour profile.

Ginger Nova: In mid‑2024, Naga entrepreneurs launched Ginger Nova, an alcohol-free probiotic drink fermented from ginger and other botanicals under the NOVA brand—still niche but promising .

HRX Metabolically Lean Supercharged: Actor Hrithik Roshan’s fitness brand HRX, in partnership with The Good Bug, introduced the Metabolically Lean Supercharged Edition (Nov 2024). This precision probiotic supplement is designed to enhance metabolic health and support weight-control goals, making functional gut-care accessible at scale

TrueNorth Sensibiotics: Ayurveda-inspired TrueNorth launched (in Mar 2024), its Sensibiotics line – including two probiotic formulas targeting gut sensitivity (with L. rhamnosus GG & S. boulardii) and feminine health (with strains such as L. crispatus, L. gasseri, L. johnsonii) using smart-release technology for targeted delivery

India’s probiotics market holds significant growth potential, driven by rising health consciousness, demand for functional foods, and increasing adoption of supplements across age groups. Innovations in personalised formulations, plant-based options, and shelf-stable products are widening consumer appeal.

The expanding Indian nutraceutical market and digital retail channels further support market acceleration. A strategic focus on affordability, quality regulation, and rural outreach will be crucial in unlocking the full potential of this dynamic and evolving market.

Read More :

The Indian probiotics market is valued at US$ 2.2 billion in 2024 and is projected to reach US$ 10 billion by 2033.

Increasing digestive disorders, lifestyle-related health issues, and post-pandemic immunity awareness are driving demand for probiotics in India.

Yogurt, probiotic drinks, dietary supplements, and plant-based probiotic options are gaining strong popularity among Indian consumers.

Key trends include plant-based and dairy-free probiotics, personalised blends, shelf-stable formats, and women’s health-focused strains.

Probiotics support gut health, improve digestion, enhance immunity, and may help manage conditions like IBS, lactose intolerance, and certain skin issues.

Lactobacillus acidophilus, L. rhamnosus, and Bifidobacterium lactis are among the most researched strains for gut health and digestion.

© Trade Promotion Council of India. All Rights Reserved.