In recent months, the price of cocoa has surged to an all-time high. At around US$10,000 per metric ton in March 2024, prices have more than doubled over the last year due to a global supply shortage, largely attributed to climate change. This surge is significantly influencing the retail pricing strategies of companies facing the challenge of managing rising input costs.

However, this global uptrend in cocoa prices presents a unique opportunity for India’s cocoa industry. With domestic chocolate consumption sharply rising, can the Indian cocoa industry rise to the occasion and meet this growing demand?

Chocolate aficionados, brace yourselves for some bittersweet times! The cocoa world is currently experiencing a dramatic upheaval, sending shockwaves through the industry. Cocoa prices have hit an all-time high of nearly US$10,000 per metric ton in March 2024, marking a staggering 136% surge from July 2022 to February 2024, as reported by UNCTAD’s commodities price monitoring.

So, what does this mean for the Indian cocoa industry and chocolate lovers alike? The ripple effect of soaring cocoa prices may soon be felt across the nation, making affordable chocolate a challenge. From local cafés to major confectionery brands, chocolate makers are now grappling with the task of maintaining quality while dealing with unprecedented costs. It’s a complex tale of supply chain challenges and market dynamics that will likely leave a lasting impact on the Cocoa Industry and chocolate enthusiasts throughout India.

One of the primary reasons behind the growing shortage of cocoa is the substantial concentration of cocoa supplies in a specific agricultural region. Cocoa trees only grow within 20 degrees north and south of the equator, requiring specific weather conditions—temperatures between 69.8-73.4 degrees Fahrenheit, high humidity, consistent rainfall ranging from 39.4 to 98.4 inches per year, nitrogen-rich soil, and protection from hot, dry winds and drought. This explains why the majority of the world’s cocoa is produced in the hot and humid regions of Africa.

West African countries such as Ghana, Nigeria, Cameroon, and the Ivory Coast are the leading producers, with Africa being the top supplier, followed by Central and South America, Asia, and Australia. However, the Cocoa Industry in Africa is currently facing severe challenges. Climate change-induced drought conditions have devastated cocoa crops in West Africa, which produces approximately 80% of the world’s cocoa. The two largest cocoa producers, Ivory Coast and Ghana, have been particularly affected by heavy rains, dry heat, and crop diseases.

Additionally, cocoa plantations receive limited investments. Many smallholder farmers who grow cocoa continue to struggle to make a living and are unable to reinvest in their land, leading to lower yields. Investor speculation is further exacerbating the situation, driving prices higher.

According to a recent report from Wells Fargo, excessive rainfall during the last crop season increased the prevalence of diseases among cocoa trees. This year, El Niño is producing dry temperatures and extreme winds, further impacting cocoa production. As a result, cocoa harvests are expected to fall short for the third consecutive year, as noted in the report.

The International Cocoa Organization projects that during the 2023–2024 season, the global cocoa supply will drop by approximately 11%, resulting in a deficit of about 374,000 tons—an increase from last season’s 74,000-ton deficit. This global shortage is a significant factor driving the sharp increase in cocoa prices worldwide, including in India’s cocoa industry.

Cocoa is a versatile ingredient that extends beyond just chocolate production, playing a significant role in various end-use industries. Here’s how it impacts the Indian market:

In India, cocoa prices, which were around Rs 180 per kg less than three years ago, have surged to Rs 325 per kg—currently the highest in 45 years. Despite this price hike, India’s chocolate consumption is projected to exceed 156 thousand tons by 2026, showcasing the country’s strong demand for chocolates. Cocoa is used not only in the chocolate industry but also in non-chocolate products like biscuits and dairy items.

The Indian chocolate market is experiencing significant growth due to several key factors. The rise of e-commerce platforms across the country has made it easier for consumers to access a wide range of domestic and international chocolate products. Additionally, manufacturers are introducing new flavors and innovative packaging formats to attract a broader audience. Responding to the demands of health-conscious consumers, companies are now offering organic, vegan, sugar-free, and gluten-free chocolates.

According to the “Indian Chocolate Market Report 2024-32” by the International Market Analysis Research and Consulting Group (IMARC Group), India’s chocolate market, which reached US$ 2.6 billion in 2023, is expected to grow to US$ 5.3 billion by 2032, at a CAGR of 7.7%.

Cocoa is a key commercial plantation crop in India, with Kerala, Karnataka, Andhra Pradesh, and Tamil Nadu being the major cocoa-producing states. The country produces around 27,000 tonnes of cocoa annually. However, the growing demand for cocoa in the Indian chocolate industry and confectioneries far exceeds domestic production, leading to a reliance on imports. India imports about 100,000 tonnes of cocoa-based products to meet industry demands.

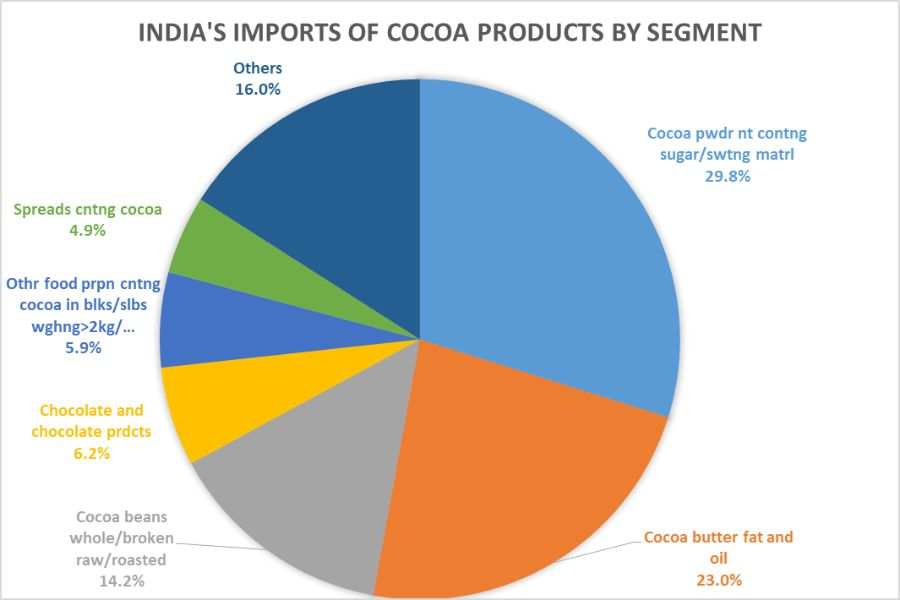

In 2023, India’s imports of cocoa and cocoa products were valued at US$ 438 million, marking a 4.9% year-over-year decline. However, over the past five years, these imports have grown at a CAGR of 10.6%. The top imported categories include cocoa powder not containing sugar or sweetening material (US$ 130.73 million) and cocoa butter, fat, and oil (US$ 100.9 million).

The country currently imports approximately 70% of its cocoa needs from West Africa and other regions. Major countries supplying cocoa products include – Indonesia, Congo, Singapore, Italy, and Uganda.

Globally, both producers and experts are in a dilemma, as this price surge is clearly unprecedented. In this context, a study from Henley Bridge ingredients has predicted that chocolate prices could stay worryingly high for the whole of 2024. Unfriendly weather conditions and rising demand from emerging markets is creating a mega supply deficit. According to the report, the market could possibly correct on its own as rising prices ultimately compel some consumer segments to shift back to imitation chocolates.

As global cocoa prices are skyrocketing, Indian cocoa growers are benefiting from higher profits and a spike in demand for the homegrown cocoa. Considering the spike in price of cocoa, farmers who have been growing cocoa as an intercrop for decades, are now beginning to focus more on cocoa crop production. The prevailing global shortage of cocoa and the consequent price rise is expected to bring about a shift of priority toward domestic cocoa sources. Many businesses may now consider procuring cocoa from within the country.

Clearly, the crop has huge untapped potential with an estimated 3 lakh hectares of irrigated coconut, areca nut and oil palm areas in the south. However Pankaj Raval, National Sales Manager, Jindal Cocoa, opines, “Indian cocoa is still in short supply, so companies have to depend on imports. Government needs to encourage cocoa production.”

A report in this regard by S. K. Malhotra, Venkatesh N. Hubballi and Chowdappa P. indicates some key strategies that need to be adopted in this direction that include:

It may be noted that India has witnessed huge growth in chocolate demand, and yet its per capita consumption remains very low at 100-200 gm per year. For a benchmark, you may consider European countries (5-10 kg per year) or even Japan (2 kg per year). On the other hand, India’s dark chocolate market surged to US$ 86 million from US$ 41 million in the past five years, a CAGR of 16 per cent, while the milk chocolate segment grew at a CAGR of 11%, according to Euromonitor.

If India successfully unlocks the formula for boosting cocoa production, it could significantly amplify economic opportunities for its farmers. This achievement would likely provide a stable and growing market for them for years to come.

Read More:

© Trade Promotion Council of India. All Rights Reserved.