Amidst the vibrant global agricultural trade landscape, bananas emerge as a crown jewel, with India positioned as a significant player in this lucrative market. As the world’s largest producer of bananas, India cultivates a rich diversity of banana varieties across its fertile lands. However, despite its vast production capacity, India’s banana exports have historically lagged behind due to various challenges, including logistical hurdles and market dynamics.

This exploration delves into the intricate landscape of India’s banana industry, highlighting the recent surge in exports and the obstacles that still hinder its full potential. From the bustling banana farms of Andhra Pradesh to the busy ports facilitating trade, we uncover the stories of farmers, exporters, and policymakers striving to elevate India’s banana Industry on the global stage.

Bananas, scientifically known as Musa acuminata, Musa balbisiana, or hybrids, are often considered the king of fruits. By some estimates, bananas are the most consumed fruit globally, with around 100 billion bananas eaten every year. Grown in more than 150 countries, there are over 1,000 types of banana varieties in existence. The most common variety is the Cavendish, which is frequently used in export markets.

Although bananas are largely grown in the tropics, their appealing flavor, high nutritional content, and year-round availability have made them highly sought after globally. Bananas are most commonly eaten fresh, but they can also be fried, mashed, or used in various value-added products like banana chips, flour, chocolates, vinegar, jam, banana bars, cakes, and wine. Their usage in value-added products helps prevent wastage due to their perishable nature.

Ripe bananas are rich in dietary fiber, potassium, manganese, and vitamins B6 and C, containing up to 22% carbohydrates. Bananas are beneficial for heart health and are known to reduce swelling, protect against developing Type 2 diabetes, aid in weight loss, strengthen the nervous system, and boost the production of white blood cells. They can also help alleviate depression and improve sleep. According to the International Glycemic Index Database, ripe bananas have a low GI of 51, while slightly under-ripe bananas have an even lower GI of 42, with a moderate glycemic load (GL) between 11 to 13.

According to FAOSTAT, global banana consumption reached 100,332 kt in 2021, marking a 3.88% increase from the previous year and showing a 13.4% growth over the past decade. India led the way, accounting for 26% of total global banana consumption in 2021.

However, as of 2023, Uganda holds the top spot for per capita banana consumption, followed by India, New Zealand, the United States, Papua New Guinea, the Philippines, Rwanda, Cameroon, and several other countries across Africa and South Asia.

Global banana production has risen significantly, from 97 million metric tons in 2008 to nearly 125 million tons in 2021, a 24% increase. The global banana industry is currently valued at $140.84 billion and is projected to grow at a compound annual growth rate (CAGR) of 0.80% from 2024 to 2029, according to Mordor Intelligence.

Banana demand saw a 1.7% increase in 2020, driven by the fruit’s peel-protected nature, affordability, high nutritional value, and immunity-boosting properties during the pandemic.

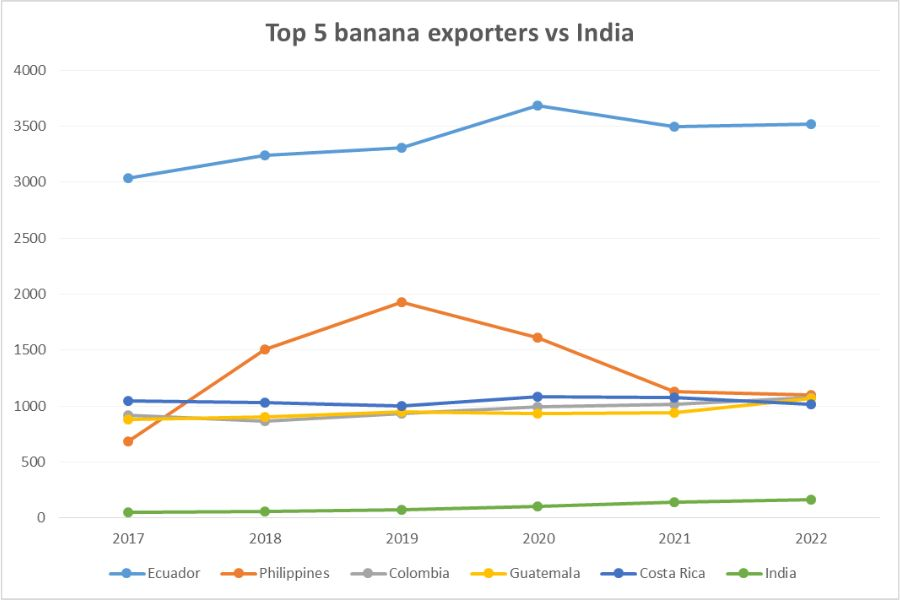

Latin American countries have consistently ranked among the largest banana exporters, with the US, China, and Germany being the major importers. Ecuador led the global banana export market in 2022, with exports valued at $3.5 billion, reflecting a 5-year compound annual growth rate (CAGR) of 3%. Ecuador accounted for 26% of global banana exports, followed by the Philippines ($1.09 billion), Colombia ($1.07 billion), Guatemala ($1.07 billion), and Costa Rica ($1.02 billion).

India ranked 18th in banana exports, with a value of $162.8 million in 2022. Despite its lower rank, India achieved an impressive 5-year CAGR of 27%, highlighting its growing presence in the global banana export market.

India is renowned as the fruit and vegetable basket of the world, thanks to its diverse climatic and geographical conditions that are ideal for horticultural crops. Banana cultivation in India involves over 25,000 farmers and provides employment for more than 50,000 individuals connected to the supply chain, both directly and indirectly. India leads the world in the production of fruits such as mangoes, papayas, and bananas.

The country’s varied agro-climatic zones support the cultivation of numerous banana varieties. Some of the most popular varieties in India include Robusta, Rasthali, Poovan, Nendran, Red Banana, Monthan, Malbhog, and Yelakki.

Among these, the Cavendish variety is in high demand for exports and is cultivated on a large scale in India to meet international market needs.

| State | Production (‘000 tonnes) | Share (%) |

|---|---|---|

| Andhra Pradesh | 5,838.88 | 17.99 |

| Maharashtra | 4,628.04 | 14.26 |

| Gujarat | 3,907.21 | 12.04 |

| Tamil Nadu | 3,895.64 | 12 |

| Karnataka | 3,713.79 | 11.44 |

| Uttar Pradesh | 3,391.01 | 10.45 |

| Total | 32,454.11 |

Andhra Pradesh is the leading banana-producing state in India, followed by Maharashtra, Karnataka, Tamil Nadu, and Uttar Pradesh. In FY 2022-23, these top five states collectively contributed approximately 67% of India’s total banana production.

According to the Advanced Estimates of ‘Horticultural Statistics at a Glance 2021-22,’ banana production decreased to 32,454 metric tons from an area of 880 hectares, down from 33,062 metric tons from 924 hectares in 2020-21.

Despite being the world’s largest banana producer, India’s global export share was just 1.2% in 2022 due to high domestic demand and the fruit’s perishability. However, Indian banana exports are rapidly growing, reaching $251.4 million in 2023, with a five-year CAGR of 35.1% and a year-on-year increase of 54%.

India’s leading markets for bananas included Iraq ($69.2 million, up 121.4% YoY), Iran ($51.9 million, up 17.3% YoY), UAE ($47.9 million, up 65.2% YoY), Uzbekistan ($23.2 million, up 124.7% YoY), and Oman ($19.3 million, up 18.8% YoY).

To boost exports, India has been establishing sea protocols for trial shipments, including providing technical guidance on harvesting and storage. A significant step was the first trial shipment of bananas to the Netherlands, flagged off on November 9, 2023, which could open up the European market.

India’s banana exports are expected to reach $1 billion within five years. The country is also exploring new markets like the US, Russia, Japan, Germany, China, South Korea, the Netherlands, the UK, and France. Additionally, Russia has recently shown interest, with a consignment of 20 metric tons shipped from Maharashtra on February 17, 2024. India’s shorter delivery times and ongoing issues with banana diseases in Ecuador offer further export opportunities.

In a discussion with Waseem Hasan Khan, Proprietor of Meem Exim, insights into the recent surge in banana exports and ongoing challenges were explored. He noted significant improvements in export practices, including quality control at the farm level, optimal bud cutting, proper transit conditions, and the use of enhanced packaging materials.

However, Khan also identified key challenges. Indian banana farms are generally smaller and more dispersed compared to large-scale exporters like Ecuador and the Philippines, affecting economies of scale and consistency in quality. With varying farm sizes, production methods, and distances, maintaining uniform quality across the supply chain is difficult.

Price instability is another major issue. Prices can fluctuate widely, from Rs 10 to Rs 30 per kg, making it challenging for farmers to secure stable income and commit to large contracts with international retailers. Unlike Ecuador, which manages large-scale contract farming effectively, India lacks a centralized body to stabilize prices.

Khan also highlighted logistical challenges. The absence of large shipping lines in India forces exporters to rely on foreign vessels, affecting transit times and product quality. Additionally, sanctions on Iran, a key transit route for exports to CIS countries, result in costly detours via Dubai, further impacting competitiveness.

Addressing these issues, such as establishing stable pricing mechanisms and improving shipping logistics, could significantly enhance India’s position in the global banana export market.

In summary, India’s banana exports have surged recently, driven by quality improvements, market expansion, and better logistics. Despite being the top global producer, challenges like perishability, farm size variations, price instability, and logistical issues limit India’s export share.

To maximize export potential, India should focus on enhancing quality control, investing in transport and storage infrastructure, stabilizing prices, and improving shipping routes. Recent trial shipments to European and CIS markets, and increasing interest from Russia, indicate promising growth opportunities. By addressing these challenges, India can strengthen its position in the global banana trade.

Read More:

FAQs

India’s fresh banana exports have surged roughly tenfold over the past decade, growing from a modest base to ~US $300 million in FY 2023‑24, up from US $176 million in FY 2022‑23, capturing 1.74% of the global market share.

India aims to reach US $1 billion in fresh banana exports within the next five years, a goal underpinned by successful sea-route trials .

Key producers include Andhra Pradesh, Maharashtra, Karnataka, Tamil Nadu, and Uttar Pradesh. UP’s Purvanchal and Awadh regions (e.g., Kushinagar, Gorakhpur) are especially active, benefitting from ODOP subsidies and farmer training .

-> Andhra Pradesh accounts for the highest banana production by volume in India.

-> It is followed by Maharashtra, Karnataka, Tamil Nadu, and Uttar Pradesh.

-> India is also the world’s largest producer of bananas, contributing over 25% of global output.

© Trade Promotion Council of India. All Rights Reserved.