India’s functional beverages market is experiencing rapid growth, driven by rising demand for drinks like non-alcoholic beverages, coffee, and fermented teas. As consumers become more health-conscious, there is a shift towards nutrient-rich options like whey beverages, and probiotics. The country’s youthful, adventurous population is increasingly open to global flavours, fueling demand for both traditional and innovative beverages.

The rise of quick commerce is reshaping retail dynamics, with faster delivery becoming a key factor in consumer behaviour. Additionally, opportunities exist for entrepreneurs to address challenges like post-harvest loss, spurring innovation in the functional beverage space.

A functional beverage, by definition, is a non-alcoholic drink that quenches thirst or enhances health and well-being by including ingredients like plant extracts, probiotics, or other essential nutrients. These beverages are commonly categorized into dairy-based, plant-based, and sports or energy drinks.

The origin of functional drinks in India can be traced back to kadhas, the traditional herbal remedies dating back to the Vedic era. These mixtures, made using ingredients like lemongrass, kwath, cinnamon, cloves, basil leaves, tulsi, and honey, have been household staples for treating various ailments. Known for their therapeutic properties, kadhas are believed to protect against infections, support detoxification, relieve respiratory stress, and boost colon health. Over time, their recipes have evolved, blending ancient practices with modern adaptations, yet they remain at the core of India’s wellness traditions.

As India evolved, so did its functional drink culture, giving rise to a variety of beverages. Chaas, the curd-based drink, became popular across the Indian subcontinent and is known by various names in different regions, offering a refreshing respite from the heat. With the rise of royalty, Badaam Milk and Kesar Milk emerged as celebrated drinks, symbolizing indulgence and health.

The most significant evolution in Indian functional drinking habits, however, came with the introduction of milk-based caffeine drinks—tea and coffee. Coffee made its unique place in Indian culture with the famous filter coffee becoming a beloved beverage. Tea already holds a sweet spot, with domestic consumption of 1,168 million kg in FY’22, according to the Tea Board of India.

And the landscape is evolving continously in line with global trends. Green and herbal drinks, popular among yoga practitioners and health-conscious individuals, are known for their immunity-boosting properties. Energy drinks, often marketed as sports drinks with zero-sugar options, cater to gym-goers and fitness enthusiasts. Whey drinks have also emerged as a popular product for this segment. Additionally, traditional beverages like Kombucha, originally from China, are gaining traction for their probiotic and digestive health benefits. This growing trend shows India embracing a diverse, health-focused, beverage culture in line with dominant global trends.

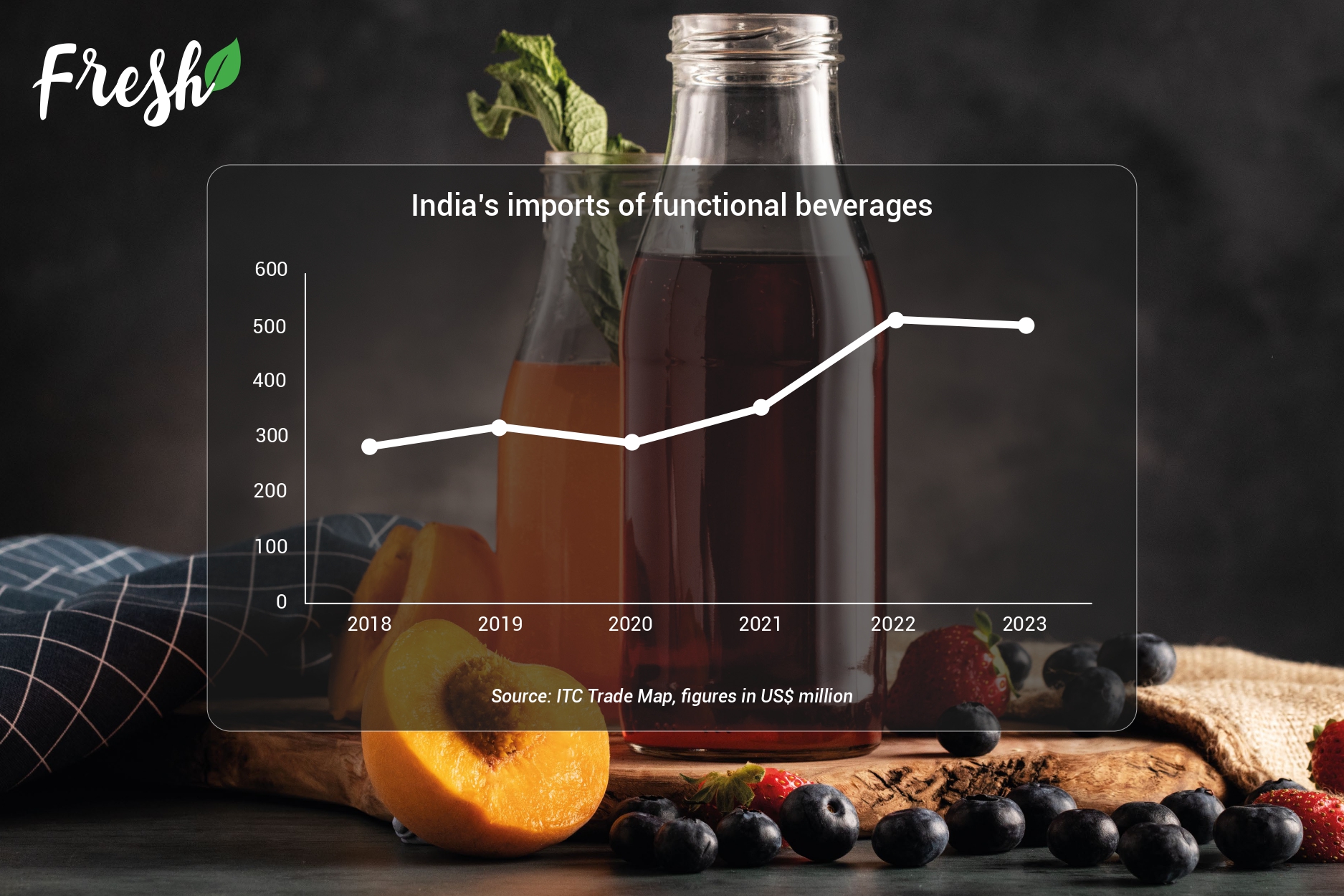

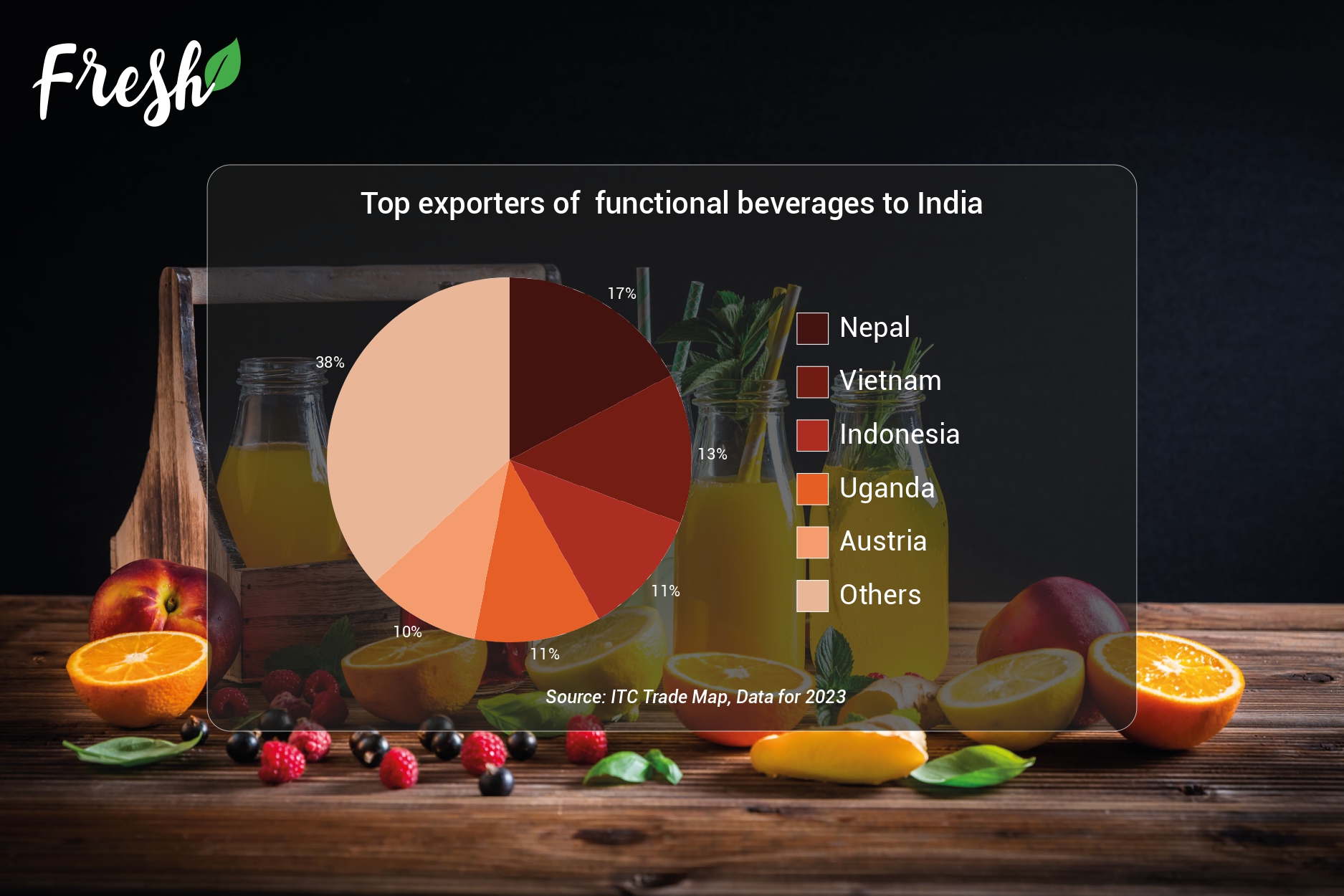

India’s functional beverage imports reached US$ 507 million in 2023, reflecting a robust 5-year CAGR of 11.9%. Nepal stands out as the top source of imports, valued at US$ 85.6 million in 2023. Non-alcoholic beverages dominate this trade, while fermented tea is the second largest import commodity.

Vietnam follows closely, with imports of US$ 65 million, primarily driven by coffee (US$ 59 million). Indonesia and Uganda ran third and fourth, collectively contributing US$ 110 million, again led by coffee.

Interestingly, Austria, a relatively negligible source until 2022, has risen to prominence. In 2023, it broke into India’s top five source markets, exporting non-alcoholic beverages worth US$ 52.5 million,

In 2023, non-alcoholic beverages and coffee maintained their positions as the top two imports within India’s functional beverages category. These were followed by black fermented tea, whey, and mineral/aerated water—both flavoured and unflavored—each demonstrating impressive 5-year CAGR growth rates.

In today’s fast-evolving retail landscape, e-commerce has emerged as a dominant force, but when it comes to beverages, traditional markets remain pivotal. The dynamics between these channels often depend on the product category, price point, and consumer preferences. This contrast is well illustrated by the experiences of Archian Foods’ Lahori Zeera and Storia Foods’ Coconut Water.

Saurabh Munjal, CEO & Co-founder of Archian Foods, highlights the importance of traditional markets for their flagship product, Lahori Zeera. “With a product priced competitively at ₹10 and ₹20, the traditional market dominates our sales, with a staggering 99:1 ratio compared to online retail,” he explains. Munjal emphasizes that products in the affordable price range rely heavily on the accessibility and scale of offline distribution channels.

On the other hand, Vishal Shah, Founder & MD of Storia Foods and Beverages, shares a contrasting perspective on his company’s premium offering, coconut water. “A few years ago, our e-commerce and traditional market sales were at a similar ratio. No consumer wanted to place an order for a beverage and wait days for it to arrive,” he recalls. However, Shah acknowledges a significant shift brought about by the rise of quick commerce platforms.

“Today, thanks to faster deliveries, our sales split between traditional and online channels has shifted to almost 50:50,” Shah explains, emphasizing the role of convenience-driven platforms in reshaping consumer behaviour.

The Indian market’s dynamic and experimental nature offers vast potential for global brands and cultural drinks, particularly as consumers become more exploratory with flavours. As Mayank Kumar, Vice President of Marketing at Dabur, aptly puts it, “Keep the consumer at the centre of any product development, addressing their concerns—hygiene, year-round demand for seasonal fruity drinks, and, most importantly, delivering them at the right price.”

Read More:

How does Indusfood contribute to the growth of India’s functional beverages industry?

Indusfood, India’s premier food expo, plays a crucial role in promoting the functional beverages industry by connecting global buyers with Indian brands. This Indian food exhibition showcases traditional and innovative beverages like whey drinks and probiotics, fostering collaborations and trade opportunities. By addressing challenges such as post-harvest losses and embracing quick commerce trends, Indusfood accelerates growth, empowering businesses to explore new markets and establish a global presence.

© Trade Promotion Council of India. All Rights Reserved.