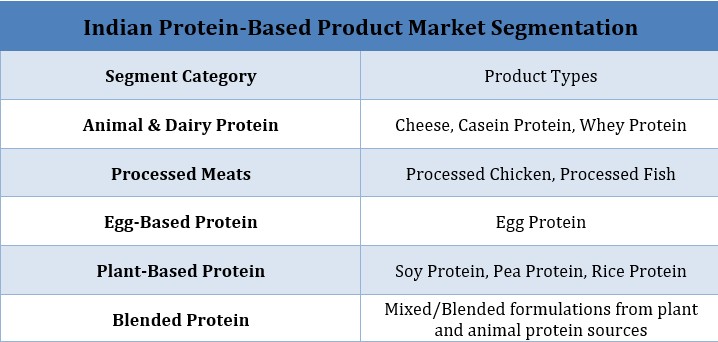

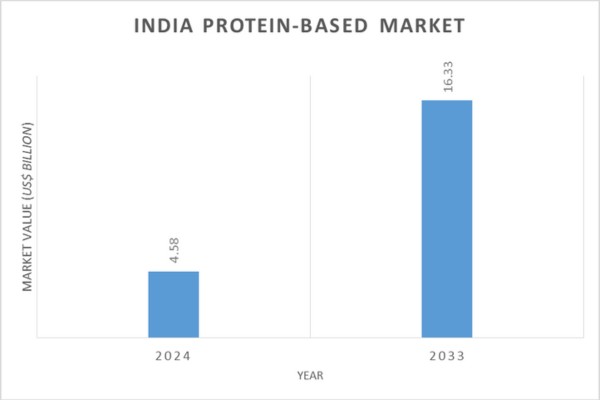

India's protein-enriched food market is rapidly expanding as consumers shift from carb-heavy diets to health-focused, protein-rich options. Driven by rising incomes, fitness awareness, and e-commerce access, demand spans dairy, plant, and animal-based proteins. Leading brands like as well as startups, are innovating with culturally relevant, affordable products. Despite growth, challenges remain—counterfeit goods, affordability barriers, and low consumer awareness. However, with a projected CAGR of 15.17%, India's protein market is set for robust growth through 2033.

India's dietary landscape is rapidly evolving as consumers move away from traditional carbohydrate-heavy staples toward protein-rich, health-oriented, and convenient food choices. Protein-enriched products have emerged as key staples in the diets of health-aware individuals. From bars and powders to supplements and fortified snacks, the expanding range of offerings caters to a wide audience seeking improved nutrition.

India's dietary landscape is rapidly evolving as consumers move away from traditional carbohydrate-heavy staples toward protein-rich, health-oriented, and convenient food choices. Protein-enriched products have emerged as key staples in the diets of health-aware individuals. From bars and powders to supplements and fortified snacks, the expanding range of offerings caters to a wide audience seeking improved nutrition.

Valued for benefits like prolonged satiety and muscle support, these protein products attract not just athletes and fitness enthusiasts but also the growing segment of the population pursuing a balanced and nutritious lifestyle. Moreover, the increasing number of gyms, fitness centres, and sporting events across India is playing a key role in fuelling market expansion.

Growing adoption of protein-enriched products

Protein based products are now commonly used by athletes, fitness enthusiasts, and those engaged in regular physical activity to support their nutritional requirements. The launch of innovative protein-based products in diverse flavours, formats, and formulations—including gluten-free, organic, low-sugar, and high-fiber variants—is further driving market growth.

In addition, rising consumer disposable incomes and the increased accessibility of these products through e-commerce platforms are also playing a significant role in fueling demand.

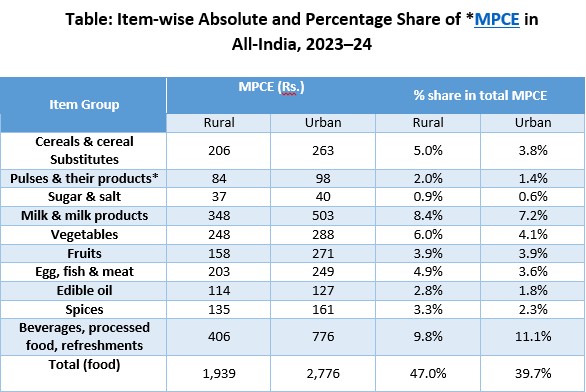

Source: Household Consumption Expenditure Survey (HCES) 2023-24; Ministry of Statistics & Programme Implementation (MoSPI); (*MPCE- Monthly Per Capita Consumption Expenditure)

Source: Household Consumption Expenditure Survey (HCES) 2023-24; Ministry of Statistics & Programme Implementation (MoSPI); (*MPCE- Monthly Per Capita Consumption Expenditure)

However, it is to be noted that daily calorie needs for both men and women are influenced by factors such as body weight, activity level, and metabolism. Protein requirements generally range from 0.8 to 2 grams per kg of body weight according to experts, depending on how physically active a person is. Since every individual has different lifestyle and fitness levels, protein needs can vary significantly—those with more active routines typically require higher protein intake than those who are less active.

With rising living standards among hundreds of millions, consumer preferences are moving beyond basic nutritional staples like rice and coarse grains toward more aspirational, protein-rich foods such as eggs, meat, and fish.

With rising living standards among hundreds of millions, consumer preferences are moving beyond basic nutritional staples like rice and coarse grains toward more aspirational, protein-rich foods such as eggs, meat, and fish.

Data for 2023–24 reveals that rural India allocated a larger share of its monthly food expenditure to cereals, milk and milk products, vegetables, eggs, fish and meat, and fruits. In contrast, Urban India prioritized spending on milk and milk products, vegetables, fruits, eggs, fish and meat, and cereals—though in a slightly different order.

Notably, beverages, processed foods, and refreshments emerged as a common category of increased spending in both rural and urban areas. However, urban households tend to spend more per item, particularly on convenient and nutrition-focused food options. These patterns reflect rising incomes, shifting dietary preferences, and a growing emphasis on balancing traditional staples with more diverse, protein-rich diets across the country.

In 2024, the market for protein-based products in India stood at ₹38,247 crore (US$ 4.58 billion). According to the India Protein-Based Product Market Report 2025-2033, by Research and Markets, the market is expected to expand rapidly, reaching ₹1,36,327.6 crore (US$16.33 billion) by 2033, with a strong compound annual growth rate (CAGR) of 15.17% projected for the period 2025 to 2033.

Shifting trend and the entry of big brands and start-ups

Dairy-based proteins have traditionally led the market, alongside animal-based sources such as eggs, chicken, and fish, which are firmly rooted in conventional diets. However, this trend is shifting, as more consumers are now relying on protein supplements to fulfill their daily protein needs.

Products such as kombucha, cold-pressed juices, plant-based milk, baked chips, protein bars, and organic nuts are seeing rising demand as they combine health benefits with enjoyable taste.

Consumers are showing a growing preference for functional foods that provide additional health benefits, including nutrient-fortified cereals, probiotic foods, and high-protein snacks.

Having said that, the deficiency of protein continues to be a significant health challenge in India, with a large portion of the population falling short of recommended daily intake—especially among children and women, who are most vulnerable to protein malnutrition.

However, the entry of major companies is expected to drive down costs and improve accessibility to protein-rich products. Rising demand for protein-enriched foods and beverages is pushing leading brands like Amul, Mother Dairy, and Parag Foods, along with emerging start-ups like Yoga Bar, to ramp up investment and focus on this rapidly growing segment. For instance:

However, the entry of major companies is expected to drive down costs and improve accessibility to protein-rich products. Rising demand for protein-enriched foods and beverages is pushing leading brands like Amul, Mother Dairy, and Parag Foods, along with emerging start-ups like Yoga Bar, to ramp up investment and focus on this rapidly growing segment. For instance:

Mother Dairy has introduced Pro Milk, a protein-enriched milk in pouch format, across the Delhi-NCR region. Pro milk will give nearly 40 grams of more protein. Containing 30% more protein than regular milk, it is priced at ₹70 per litre—just slightly above the brand's full-cream milk, which sells for ₹68 per litre.

The company notes that about 70–80% of Indians do not meet their daily protein requirements, despite the growing availability of protein-rich products. This trend is especially evident among vegetarians. Rising protein deficiency is fuelling demand for high-protein foods in various forms. In response, Mother Dairy plans to expand its portfolio with Greek yogurt and high-protein paneer.

Parag Milk Foods has unveiled an expanded portfolio of protein-rich products, moving beyond its traditional sports nutrition offerings focused on muscle-building. Known for its dairy brands like Gowardhan ghee, Go cheese, and Pride of Cows milk, the company will now offer a wider range of protein-enriched items, including low-fat, high-protein paneer, flavoured Greek yogurt with 8g of protein, as well as protein bars and snacks.

Gujarat Co-operative Milk Marketing Federation Ltd, known for its Amul brand, has been expanding its range of protein-rich offerings. The lineup includes high-protein beverages such as lassi and milkshakes (priced at ₹40 for 180 ml), as well as protein-enriched milk and paneer, catering to the growing demand for functional, nutrition-focused foods.

Bengaluru-based Sproutlife Foods, which began with energy bars, has expanded its offerings to include protein biscuits, shakes, and chocolates. The company observes that the protein-rich food market has significantly evolved over the past decade, shifting from a niche focus on fitness enthusiasts to a broader consumer base. Most recently, Sproutlife launched protein powders, further tapping into the growing demand for daily protein intake.

Start-ups and established brands are innovating to make traditional foods protein-rich without altering eating habits. For instance, iD Fresh Food has launched high-protein dosa and idli batters using millets and legumes. In the roti segment, Aashirvaad's Multigrain Protein Atta features as a prominent example. New players like The Whole Truth and Eatopia are offering functional flours packed with protein. Meanwhile, products such as Kellogg's K Protein cereals, Epigamia Greek Yogurt, and The Protein Bakery's snacks are fortifying everyday staples like cereals, pancakes, and yoghurts with added protein.

Brands today are moving past traditional supplement models by prioritizing cultural relevance, ease of use, and well-rounded nutrition, creating a unique and integrated ecosystem for consumers.

Challenges and opportunities

India's protein-based product market holds immense promise, but several key challenges continue to impede its full potential.

One major concern is the proliferation of counterfeit products, which significantly erodes consumer confidence and compromises market integrity. These illegitimate products often contain inferior ingredients, carry misleading labels, and may even pose health risks due to contamination. Addressing this issue demands coordinated efforts from industry stakeholders, regulatory authorities, and law enforcement to uphold product quality and protect consumer well-being.

Affordability is another pressing issue, particularly for lower-income groups. The comparatively high cost of protein supplements and fortified foods creates a barrier for many, limiting their access to essential nutrition.

Additionally, there is a critical need to enhance consumer education. While awareness of protein's health benefits is on the rise, many individuals remain unaware of the recommended intake, the role of protein in a balanced diet, and the risks of excessive supplement use. It is essential for companies, healthcare experts, and government agencies to collaborate in spreading reliable information and encouraging informed, responsible consumption.

Despite these challenges, India's protein market is poised for significant growth, with numerous opportunities on the horizon.

A key area of potential lies in the largely untapped rural segment. As incomes rise and nutritional awareness spreads across rural India, demand for protein-enriched products is expected to grow substantially.

Driving this momentum will be the development of innovative, affordable, and culturally attuned protein solutions. Many companies are exploring new formulations that incorporate traditional Indian ingredients and offer convenient formats tailored to local preferences. This shift toward localization is likely to resonate with consumers seeking products that align with their dietary habits and cultural values.

Government initiatives (like Eat Right India, food fortification) will also play a vital role in shaping the future of the market. Policies that promote the cultivation of protein-rich crops, support the fortification of staple foods, and raise public awareness around protein deficiency can help foster greater consumption. Together, these efforts will contribute to building a more robust and inclusive protein ecosystem across the country.

Conclusion

India's protein-enriched food market is evolving beyond niche segments to become a mainstream dietary preference, reflecting broader trends in health-conscious living and preventive wellness. Consumers are increasingly seeking functional foods that offer multiple benefits—taste, convenience, and nutrition. The rise of startups, technological advancements in food processing, and tailored product development for Indian palates are accelerating innovation. Additionally, the growing influence of social media and fitness influencers is shaping consumer choices. As protein deficiency remains a concern, sustained awareness campaigns and affordable solutions will be vital.